TeraWulf expands AI push with $9.5 billion Google-backed Fluidstack joint venture as stock jumps 25%

TeraWulf, the sixth-largest public bitcoin miner by market cap, has deepened its pivot toward artificial intelligence infrastructure, announcing a new joint venture with AI cloud platform Fluidstack to develop a 168-megawatt data center in Abernathy, Texas.

The project, underpinned by a $1.3 billion lease-backing commitment from Google, marks the firm's largest step yet into high-performance computing and expands its total contracted capacity to more than 510 MW, TeraWulf said in a statement.

The 25-year hosting agreement gives TeraWulf a 51% ownership stake and represents roughly $9.5 billion in contracted revenue for the venture. The facility will serve workloads for a global hyperscale AI platform focused on frontier-scale foundation models, with construction expected to be completed in the second half of 2026. TeraWulf said the project will cost between $8 million and $10 million per megawatt of critical IT load and will be financed through project-level debt backed by Google's lease obligations.

The announcement follows Fluidstack's recent expansion at TeraWulf's Lake Mariner data center in New York, where the companies secured $3.7 billion in AI hosting contracts supported by Google's $3.2 billion lease guarantee and warrant position. With the new Texas project, TeraWulf has also secured an exclusive option to participate in up to 51% of Fluidstack's next 168 MW build under similar terms, extending what has become one of the largest AI data center build-outs by a bitcoin miner.

"We are very pleased to deepen our strategic alignment with Fluidstack and Google through this long-term joint venture," TeraWulf CEO Paul Prager said in a release. "On our last conference call — immediately following the Lake Mariner announcement — I made clear that our focus was execution, execution, execution. Today's transaction demonstrates that execution in practice."

Fluidstack co-founder César Maklary added that the partnership builds on the companies' collaboration to deliver next-generation GPU clusters for foundation model developers. "TeraWulf brings exceptional operational discipline, energy expertise, and development scale at precisely the moment the market requires hardened, sustainable infrastructure," he said.

Preliminary Q3 results

Alongside the joint venture announcement, TeraWulf released preliminary third-quarter results showing revenue between $48 million and $52 million — up about 84% year-over-year — and adjusted EBITDA of $15 million to $19 million compared to $6 million in the third quarter of 2024.

TeraWulf credited the growth to its strategic shift toward long-duration HPC hosting contracts backed by investment-grade counterparties. CFO Patrick Fleury said the company's expanding contracted critical IT load "reinforces the scalability of our platform and our ability to unlock value through disciplined capital deployment alongside world-class partners."

The momentum has also drawn fresh attention from Wall Street, with investment bank and brokerage firm Oppenheimer reportedly initiating coverage on TeraWulf on Tuesday with an outperform rating and a $20 price target, citing its AI pivot and control of low-cost renewable sites as catalysts. The analysts projected that global data center demand will continue to exceed supply in the coming years — an environment that positions TeraWulf to grow its contracted HPC portfolio by another 250 to 500 MW annually.

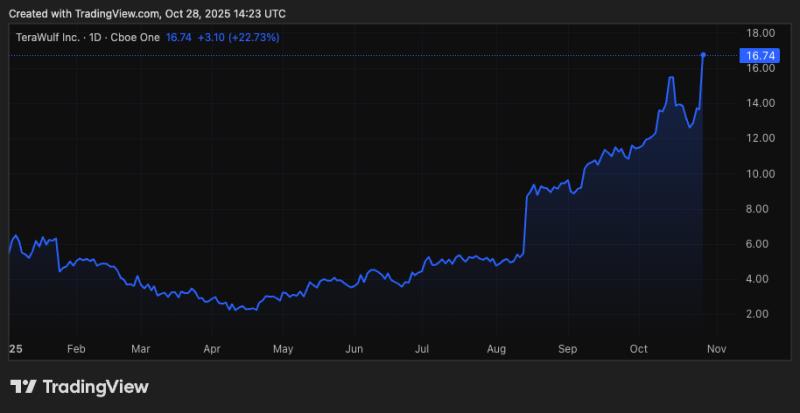

According to The Block's TeraWulf price page, its stock is up around 25% at $16.92 in early trading on Tuesday following the news, having already gained 134% year-to-date amid a market boom for AI-diversifying bitcoin miners in recent months.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.