Coinbase and MicroStrategy: Bitcoin Volatility Weighs Heavy

Trend Analysis

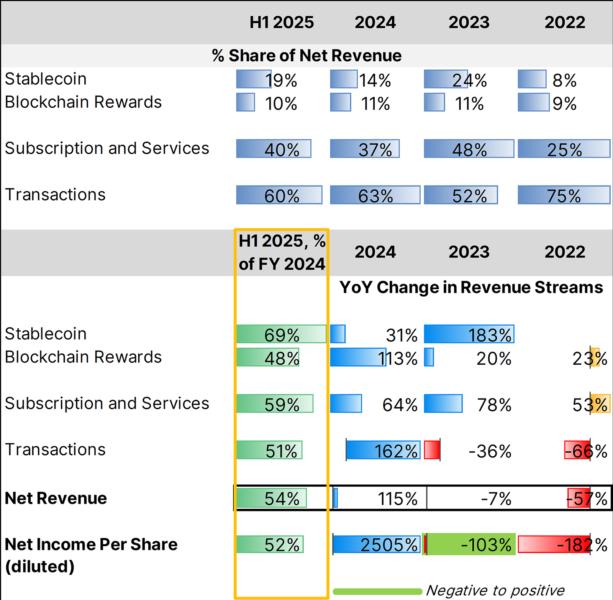

On the 31st of July, Coinbase released its second quarter (Q2) earnings for 2025, thereby marking the end of the first half (H1) of its Fiscal Year (FY) 2025. While stablecoin-driven revenue has more than doubled in contribution share to total revenue in H1 2025 relative to FY 2022, transactions – which is a barometer for crypto market activity – has seen a 20% drop over the same time period.

Source: Company Information; Leverage Shares analysis

Stablecoin continues to show the best growth in activity; if current trends continue, stablecoins will close out the current FY with a massive 38% growth over last FY. Closely correlated are Subscriptions and Services – which encompass non-trading revenue streams that include stablecoins, staking, custody services and subscription-based offerings for trading, staking, et al. This segment is currently trending to close out with an 18% increase over last FY. Transactions, meanwhile, is trending towards a meager 2% increase – a far cry from previous FY’s triple-digit percentage growth.

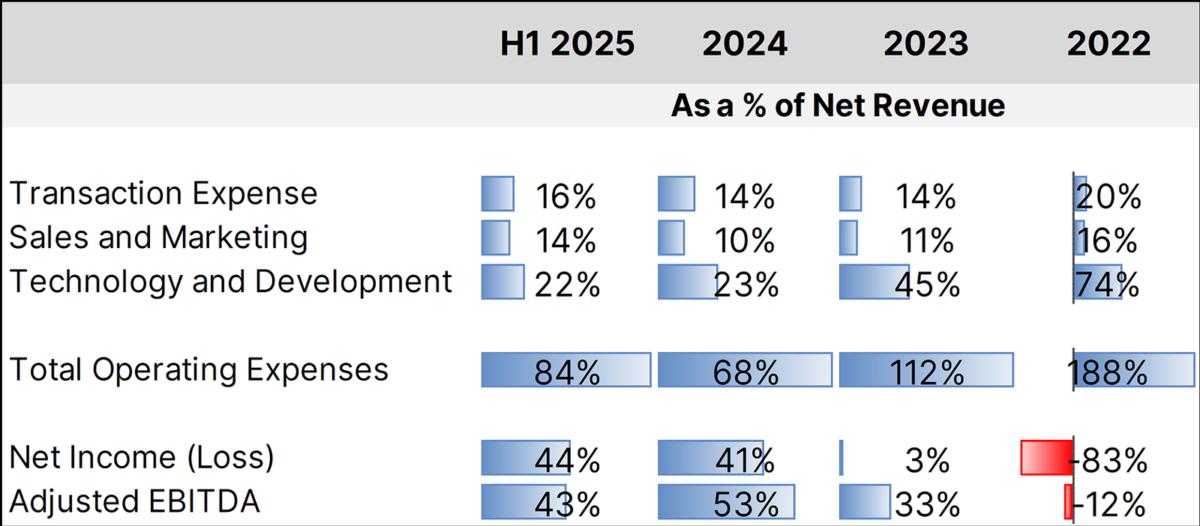

In terms of expenses, transaction expenses, sales and marketing and technology impact on revenue are at three-year lows all together.

Source: Company Information; Leverage Shares analysis

Stablecoin continues to show the best growth in activity; if current trends continue, stablecoins will close out the current FY with a massive 38% growth over last FY. Closely correlated are Subscriptions and Services – which encompass non-trading revenue streams that include stablecoins, staking, custody services and subscription-based offerings for trading, staking, et al. This segment is currently trending to close out with an 18% increase over last FY. Transactions, meanwhile, is trending towards a meager 2% increase – a far cry from previous FY’s triple-digit percentage growth.

In terms of expenses, transaction expenses, sales and marketing and technology impact on revenue are at three-year lows all together.

Source: Company Information; Leverage Shares analysis

While operating expenses are high relative to previous FY, pass-throughs to net income are at three-year highs.

Therefore, with all expenses in consideration, the volatility of the crypto market weighs heavily on its investors. Stablecoins offer a convenient “ramp” into and out of cryptocurrencies; the rise in stablecoin holdings indicate that an increasing number of investors have a higher tendency to have a proxy to fiat capital at hand within the blockchain in anticipation of crypto market stability rather than invest into cryptocurrencies presently.

The more-or-less undisputed king of the cryptocurrency space is Bitcoin (BTC), which has had a pretty rocky road in the year so far. Arguably, nowhere has this rocky path been more impactful than in MicroStrategy (or “Strategy”), which has steadily evolved from being a software and services company servicing the cryptocurrency market to an entity that defines itself as a “Bitcoin Trust” company.

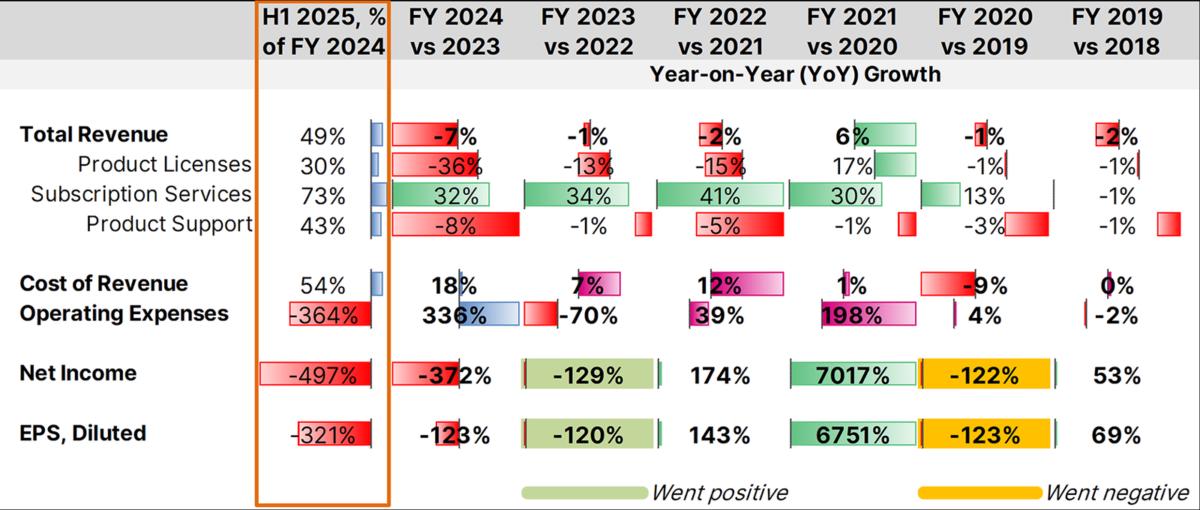

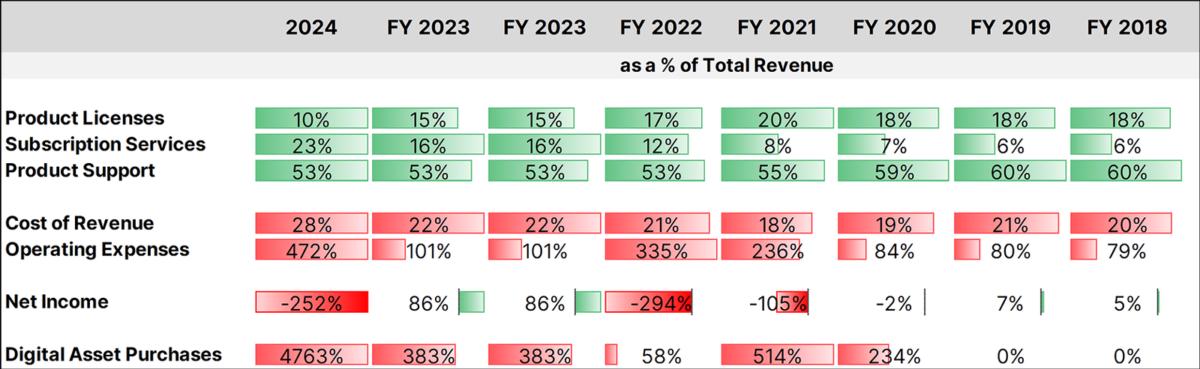

While a declared software and services company, MicroStrategy ploughed its business earnings into buying up Bitcoin in vast volumes over the years – which had a particularly keenly-felt impact in the company’s balance sheet even on the 31st of July, which is when the company declared its Q2 earnings results for FY 2025

Source: Company Information; Leverage Shares analysis

While revenues from its then-mainstay technology business saw a slight overall uptick in FY 2021, it has been in decline since. Currently, trends indicate that revenue will likely close out the current FY with a 2% decline. However, subscription licenses of MicroStrategy One – an AI-powered business intelligence (BI) platform that combines analytics and AI capabilities much like those on offer from Oracle and Microsoft – continues to grow from existing users year on year.

However, nearly every other line item is impacted by the high cost of Bitcoin acquisition (in previous FYs) and the unrealized gains/losses of holding such a volatile asset.

Source: Company Information; Leverage Shares analysis

So heavy is the volatility of the assets it’s holding that their impact on operating expenses and net income far outweigh the revenues/earnings from its technology business. Thus, it might be entirely apropos for the company to deem itself as a “Bitcoin Trust” company rather than a technology company operating adjacent or within the crypto world. In Conclusion

While both companies are in the thick of the crypto world, Coinbase’s status as a service provider to investor makes it more dependent on evolving investor preferences and choices. While the stablecoin business gives it a hedge, transactions within crypto markets had long been its revenue driver. On the other, MicroStrategy’s fortunes remains directly linked to Bitcoin’s price volatility.

While Bitcoin’s price volatility remains central to both companies, its impact to the bottom line is less direct with Coinbase than with MicroStrategy. The latter will essentially have to sink or swim with Bitcoin.