Reddit Stock: Strong Growth, But Still No Bargain

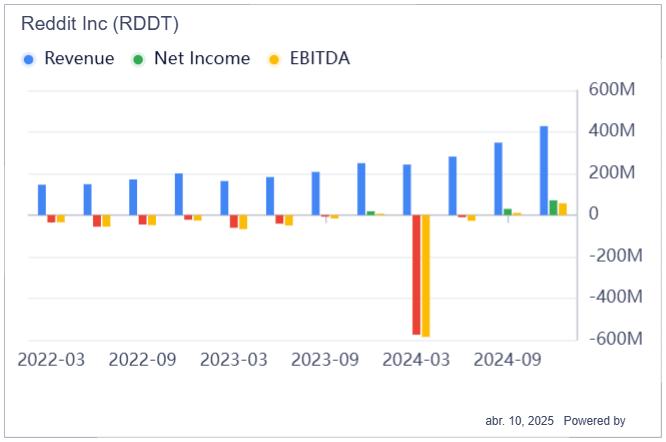

Reddit RDDT is a social platform that, although niche, has already achieved strong metrics and shown significant improvements since its IPO. For instance, look at the chart below to see how the company managed to improve revenue and margin and achieve a positive net income and EBITDA.

Source: GuruFocus

Although its IPO is recent (2024), it has already accumulated 121% gains, even after the 50% downward correction of its all-time high (ATH), which draws attention and makes some think this could be a good buying opportunity.

As Reddit's fundamentals still have a long way to go, short-term multiples (such as the forward P/E) tell us very little of the story. So, let's explore the long-term potential and do some math to try to justify this investment thesis.

Reddit Has a Huge Long-Term Potential

Unlike Meta META and Alphabet (GOOGL, GOOG), which are very mature companies and manage to extract a lot of value from their users through advertising, Reddit is at a different stage. It is still optimizing its platform to attract more and more users, and in the midst of this, improving its forms of monetization, such as ads and Reddit Premium.

Making the example even more concrete, think about how Instagram has already managed to add ads in different places and at a relevant volume, while Reddit is still finding the best ways to do it.

In Q4, Reddit already had 380 million weekly active users and reached 101.7 million DAUs after YoY growth of 39%, billions of posts and comments, and it continues to consolidate itself as a social network at a very rapid pace.

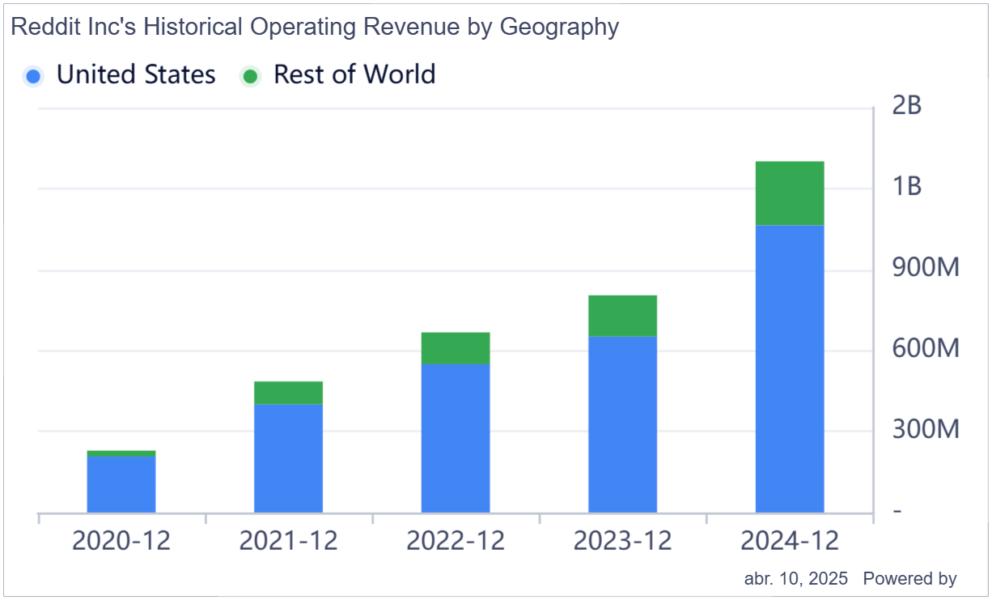

In the long term, these initiatives should continue to unlock value for the shareholder. Note in the chart below how, in just a few years, the company has managed to double its revenue and achieve greater relevance in International revenue.

Source: GuruFocus

Of course, as already mentioned, there is no shortage of competition for advertising (or rather, there is an excess of it). Platforms are constantly vying for attention and users, with different trends catalyzing this, such as the short video trend that has even led to young people using TikTok as a search instead of the traditional Google.

Just as TikTok has its search appeal, so does Reddit. Reddit differentiates itself by having very well-established and engaged communities with a strong human touch. In Q4, for example, there was an increase in people looking for product reviews, such as gift ideas or what product to buy for life. Many of these discussions are also timeless, with more than 20 years of posts and discussions about different problems that can help, for example, someone who is experiencing an error when using specific programs and so on.

With these characteristics already well established (and still growing), Reddit has some ways of monetizing and continuing to evolve. The company continues to create new products, such as Reddit Answers, powered by gen-AI, which aims to improve the user experience using the vast content base that the platform has. Machine Translation is also an initiative that expands the addressable market by making posts available in different languages, as the key point (extracted from the Q4 earnings call) below shows.

The introduction of AI-powered tools like Reddit Answers and machine translation in multiple languages is enhancing user engagement and accessibility.

There is still a lot to be done in the core of revenue, which is advertising, but the company already has automation and AI initiatives in place to further improve campaign efficiency. The latest data suggests that the advertiser return is $20.

With millions of users and brand awareness, there is massive potential to be exploited going forward. In addition to the advertising I've already mentioned, the increase in the Reddit Premium user base, growth in content licensing, or the addition of paid content subreddits, which has already been mentioned by the CEO, could greatly increase revenue per user in the coming years.

Reddit Stock Isn't a Bargain Yet

Reddit's forward price-to-earnings is 83x, but as I mentioned, this is of little importance given the company's profile.

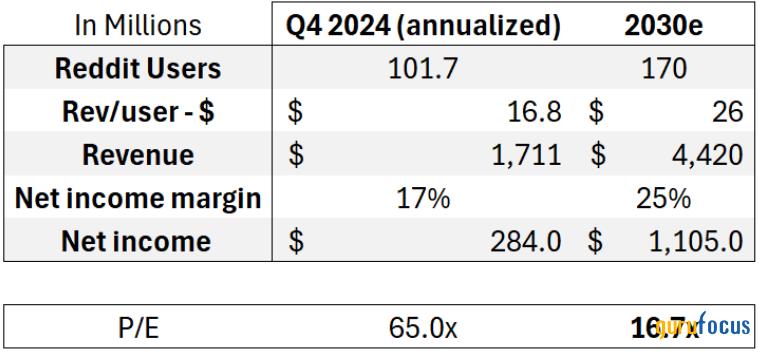

To check its real shareholder remuneration potential over the next few years, let's draw up an achievable scenario in line with these trends.

In YoY, Reddit managed to add more than 28 million DAU. But as it is already consolidated, let's assume that in the long run, the addition will be substantially lower. With an increase of 10 to 15 million users per year, by 2030, the company could reach 170 million DAUs, and it's worth remembering that there are almost 400 million users every week, meaning that the company has the potential to increase the recurrence of these less engaged users.

Revenue per user (Q4 annualized) is $16.8. For comparison purposes, Meta's was $14.4 in Q4 alone, i.e., annualized, it would be around $58 per user. This assumption, I believe, is where there is the most potential for positive surprises in the coming years. However, let's be conservative and assume that by 2030, the company will be able to reach $26 per user (it would need a CAGR of ~8% over this period, which seems achievable).

That would be enough for Reddit to reach over $4.4B in revenue. A net income margin of 25%, which would be an expansion of ~8 percentage points in 5 years, results in a net income of $1.1B, equivalent to a price-to-earnings of 16.7x for 2030.

Source: Author (Kenio Fontes)

Although there is the potential for positive surprises down the road, which could consequently increase net income by a lot in 2030, Reddit's valuation, even if it has fallen significantly, still doesn't look like a bargain.

Even after waiting 5 years, the investors would still have an earnings yield below 6%. Still, if we consider a fair multiple of 25x for 2030, the upside would be 50% over a relatively long period.

That's why I understand that even with a lot to be unlocked over the next few years, Reddit still doesn't have a sufficient margin of safety to justify the investment.

The Bottom Line

Even though its valuation is still stretched and it already incorporates good operational advances (which seem plausible over the next few years), Reddit is an interesting company that could surprise you over the next few years as its initiatives mature and new monetization opportunities arise.

That's why I think it's interesting to keep the stock on the radar, but for now, I think it's more prudent to stay out of it.