The Brokerage That Makes More From Fewer Clients: Is Interactive Brokers Still Undervalued?

In July, I laid out the case for why Interactive Brokers IBKR stood apart by focusing on fewer, richer clients. Since then, the thesis has held up operationally. Interactive Brokers has continued to add accounts, grow assets and widen its margins. It was added to the S&P 500 in August, and Q3 results showed another solid quarter of high-quality growth. But the stock's performance has lagged more speculative names. Robinhood

HOOD has more than tripled year to date, while Interactive Brokers is up closer to 50%.

In this article, I'll update my thesis in light of the company's Q3 2025 performance. I'll break down its business model and competitive edge, assess the health of client growth, review the latest product and client trends, and assess its valuation.

Business Model

Interactive Brokers is a global leader in electronic trading, known for its technology-driven, ultra-low-cost platform spanning stocks, options, futures, forex, bonds, and more. Unlike flashy apps that gamify trading, Interactive Brokers has historically targeted a more professional investor base: active traders, hedge funds, financial advisors, and institutions. This focus on sophisticated, specialized clientele shows in its numbers. With just over 4 million accounts, Interactive Brokers oversees a massive $757.5 billion in customer equity. The firm's international reach (customers in 200+ countries) and breadth of offerings (everything from US stocks to European options to Asian futures) attract serious investors and institutions that want a one-stop platform.

In my view, Interactive Brokers is one of the top platforms for professionals. In recent years, management has also shifted focus toward the retail segment. Over the past few years, Interactive Brokers has offered IBKR Lite, which offers zero-commission trading but generally retains a larger spread on client cash. The goal is to blend the high-value professional cohort with a growing retail crowd.

The company launched ForecastEx, a CFTC-regulated prediction-market venue that lets clients trade yes-or-no contracts on macro data, central bank decisions, and climate outcomes. All for a transparent one-cent fee.

By Q3, Interactive Brokers offered over 8,200 forecast contracts (up 27% from last quarter) on its platform, and volumes traded in these grew 165% in Q3 (versus Q2). They also extended trading hours for forecast contracts to nearly 24/7. These contracts let clients bet on things like where an index will be at week's end, or the outcome of an event, in a regulated way. It's a niche but growing segment, appealing to the same folks who might trade futures or options for speculation. Even Robinhood has partnered with Interactive Brokers' ForecastEx to offer these event contracts to its users.

Other retail-focused product innovations include Investment Themes, an AI-driven discovery tool that helps investors turn market trends into actionable ideas, and the 24-hour U.S. stock session, which allows trading outside regular hours. However, one area where the company continues to face difficulty is crypto adoption.

Interactive Brokers allows clients to trade Bitcoin, Ethereum, and a handful of major coins through regulated partners, with commissions well below those of typical crypto exchanges. It even added Solana to the crypto lineup and introduced recurring crypto buy orders (dollar-cost averaging feature). Some Interactive Brokers' clients are embracing digital assets now that they can do so on the same platform as stocks and futures. Still, crypto remains a negligible portion of Interactive Brokers' revenue.

The company was late to the party, and because of that, many investors have their crypto portfolio elsewhere. One challenge is persuading new customers to bring their crypto holdings onto the platform. The U.S. still doesn't allow in-kind crypto transfers between brokers. As a result, investors looking to move their crypto holdings to Interactive Brokers typically must liquidate their positions elsewhere, triggering taxable events. This friction discourages switching and limits inflows from seasoned crypto investors. New legislation, such as the GENIUS Act, aims to create a framework for direct crypto access within brokerage accounts. Interactive Brokers has expressed interest in expanding its crypto functionality if/when regulations permit, which could further boost account inflows from crypto holders looking for better security or rates.

All these factors give Interactive Brokers a durable edge in my opinion. The company consistently wins top rankings for best online broker and prime broker.

Q3 2025 Financials

Interactive Brokers' third-quarter results underscore just how powerful its model has become in the current environment. Net revenues were up 21% to $1.655 billion (GAAP), but the core client and engagement metrics climbed more than 30%.

Source: Author

The company isn't just adding accounts, it's growing active, revenue-generating relationships. Evidence for this is seen in the discrepancy between client account growth and trading activity. Client accounts grew substantially, surpassing the 4 million mark to reach 4.127 million, this represented a 32% increase YoY. Daily Average Revenue Trades (DARTs) surged even faster, hitting 3.616 million, up 34% YoY. Even more notably, customer equity grew 40% to over $750 billion. This was driven by a combination of net inflows and asset appreciation, as clients added new capital and benefited from rising markets.

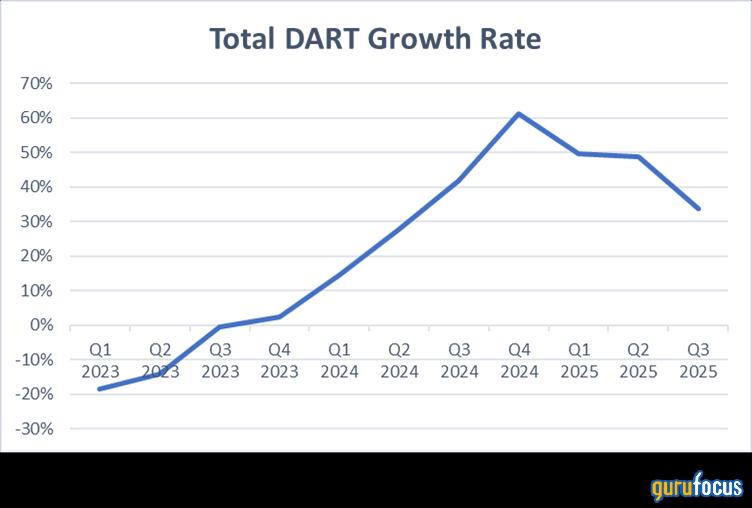

Despite the impressive growth rates for the quarter, in my opinion, the market wasn't impressed. While DART growth remains strong, it peaked in Q4 2024 and has trended lower since. However, this acceleration in DARTs relative to account growth confirms the focus on the highest quality clientele.

Source: Author

These metrics fed directly into the two main pillars of revenue: commissions and net interest income (NII).

Commission reached $537 million, up 23% YoY, driven mainly by customer trading volume in stocks and options. The spike in equities volume partly reflects higher trading in low-priced stocks (possibly with more retail increasing interest and risk). To further boost client engagement, the average commission per trade fell to $2.70, helped by rebate capture and the removal of SEC fees. But volume strength more than offset the lower take per trade. Despite the challenges in attracting crypto assets that I mentioned above, Interactive Brokers' crypto trade volume rose 87% from last quarter and is up more than 5x YoY. While this is compared to a very small base, it is a sign of the growing strength of its offering.

NII reached a quarterly record of $967 million, representing a 21% increase YoY. This growth occurred despite lower benchmark rates in most major currencies, driven by higher balances and savvy positioning. Customer margin loan balances jumped 39% YoY to $77.3 billion as clients leveraged up into the rising market. Customer cash balances rose 33% to $154.8 billion. In other words, even at slightly lower rates, Interactive Brokers earned interest on a much bigger pool of cash and loans. Additionally, securities lending revenue boomed. Interactive Brokers lends out client-owned stocks to short sellers and shares half the profit with clients. The CFO highlighted a significant rise in the notional value of securities loaned, with strong short demand and more specials (hard-to-borrow stocks) this quarter. This is a quiet engine of profit for Interactive Brokers though. Finally, Interactive Brokers kept its own investment portfolio at less than 30 days duration to benefit from the yield curve inversion. This flexibility added to NII.

NII will likely be pressured by Fed policy. The Fed cut rates by 25 basis points in September and is expected to cut another 50 basis points by year-end. Management has been very transparent about this potential cyclical risk. A 25 basis point decrease in the Fed funds rate is estimated to result in a $77 million reduction in annual net interest for Interactive Brokers. With trailing twelve-month NII around $3.4 billion, the projected $150 million impact would reduce annual income by about 5%. While rate cuts are a headwind and will impact the NII growth rate, the impact is systematically diluted by the continuous growth in interest-earning assets. Moreover, Rate cuts could also be perceived as positive for equities, potentially lifting client activity and boosting commission revenue.

| Metric | Q3 2025 Value | YoY Growth (%) |

| Total Client Accounts | 4.127 Million | +32% |

| Daily Average Revenue Trades (DARTs) | 3.616 Million | +34% |

| Ending Client Equity | $757.5 Billion | +40% |

| Ending Client Margin Loans | $77.3 Billion | +39% |

| Net Interest Income (NII) | $967 Million | +21% |

| Commission Revenue | $537 Million | +23% |

Source: Author

On the bottom line, GAAP diluted EPS was $0.59, up $0.14 from a year ago. Net income (including noncontrolling interests) totaled $1.2 billion for the quarter, but due to Interactive Brokers' unique ownership structure, only $263 million of that net income was attributable to the publicly traded common stock. This still represented solid growth, achieving a 16% net margin.

The company split its shares in a 4-for-1 stock split in June. Whether related or not, the stock is up over 25% since then.

Valuation

The market is valuing Interactive Brokers as a category leader, but not, in my view, irrationally.

Source: Author

At a $112.6 billion market cap, Interactive Brokers trades at 32x trailing earnings (P/E), 29x forward P/E, and carries a PEG ratio of 1.8x, based on consensus revenue growth of 16% next year and 11% over two. I would argue that revenue growth will exceed those forecasts. Its 5.8x price-to-book is rich by industry standards, but far from alone.

However, it's not alone in wearing a premium. Robinhood, which generated just a fraction of Interactive Brokers' revenue last year, trades at an even loftier $115.5 billion valuation. It carries a forward price-to-sales ratio of 23.6x, a forward P/E above 56x, and a price-to-book over 14, a tech-stock valuation built on 44% revenue growth expectations next year. Charles Schwab SCHW, by contrast, looks conservative on earnings at 17x forward but elevated on sales at 6.7x forward revenue.

But the more telling comparison is through unit economics (what the market is paying per client or per dollar of assets).

Source: Author

This is where the distinction between a wealth manager and a brokerage utility becomes clear. With $11.59 trillion in assets, Schwab leads on scale, averaging over $253,000 per account. Its strategy as a financial services giant focuses on capturing and retaining large wealth pools, including retirement and advisory assets above all, segments that typically generate lower trading volume per account.

Interactive Brokers' clients average over $183,000 per account, validating its focus on high-net-worth professionals and institutions trading globally. Robinhood, with just over $11,000 in average assets, sits firmly at the retail, entry-level end of the spectrum.

The gap in customer quality is reflected in how the market values each account. Interactive Brokers commands an implied market value per client that is six to seven times higher than Schwab or Robinhood. At $27,280 per customer, the market is signaling that Interactive Brokers' clients are far more valuable, and the market recognises that. It confirms that the market views Interactive Brokers as attracting sophisticated clientele, highly active traders who generate superior, high-margin revenue through complex products, high trading velocity, and significant margin utilization. Even in a down market, these clients are more likely to stay engaged, given their expertise and investment range.

In contrast, Schwab's low $3,740 value per account reflects its scale and mature model, while Robinhood's slightly higher figure of $4,320 is tied to a growth premium. The market is betting on long-term monetization from a younger, low-asset customer base.

In the second quarter, Interactive Brokers once again drew attention from top-tier investors. Paul Tudor Jones (Trades, Portfolio) and Ray Dalio (Trades, Portfolio) both exited their positions. In Dalio's case, it was surprising. He closed out his stake just one quarter after initiating it, a stake that had made him one of Interactive Brokers' largest guru shareholders. Meanwhile, other prominent investors, including Ken Fisher (Trades, Portfolio), Ron Baron (Trades, Portfolio), and George Soros (Trades, Portfolio), increased their holdings.

Key Risks and Challenges

While Interactive Brokers continues to fire on all cylinders, it isn't immune to external pressures that could test the durability of its growth story.

One of the more tangible headwinds is China's tightening regulatory stance. Mainland authorities have imposed new restrictions on foreign brokers onboarding domestic clients, forcing Interactive Brokers to require offshore residency verification and to remove its app from major Chinese platforms. Management says this hasn't materially affected account growth, but China has historically been a rich source of new, high-value clients. If restrictions intensify or formal bans emerge, Interactive Brokers could see its Asian growth trajectory slow, particularly in light of the company's heavy emphasis on international expansion.

A second, more cyclical risk stems from market activity and investor sentiment. A large portion of Interactive Brokers' top-line growth still depends on trading volume and margin lending. The model is structurally strong, but it doesn't escape market corrections. In the third quarter, margin loan balances hit $77 billion, not just because markets were rising, but because clients actively increased their risk exposure to chase upside. That works well in a bull market. But leverage amplifies everything. If markets turn, those same accounts could unwind rapidly, cutting into interest income and increasing risk management costs if clients liquidate at a loss.

My Final Take

Interactive Brokers' Q3 2025 results reinforce why I've remained bullish on its fewer, richer clients model. The firm is executing across the board, driven by a strategy focused on serious investors, global reach, and technology that actually compounds margin. In the span of a few years, Interactive Brokers has transformed from a niche electronic broker into a financial powerhouse, now even a member of the S&P 500. And that transformation looks far from over.

I continue to see Interactive Brokers as a long-term compounder. Its edge, from technology, cost efficiency, global reach, to high-value clients, remains intact. The valuation isn't cheap, but it isn't stretched either, especially if the market is underestimating the growth runway ahead.

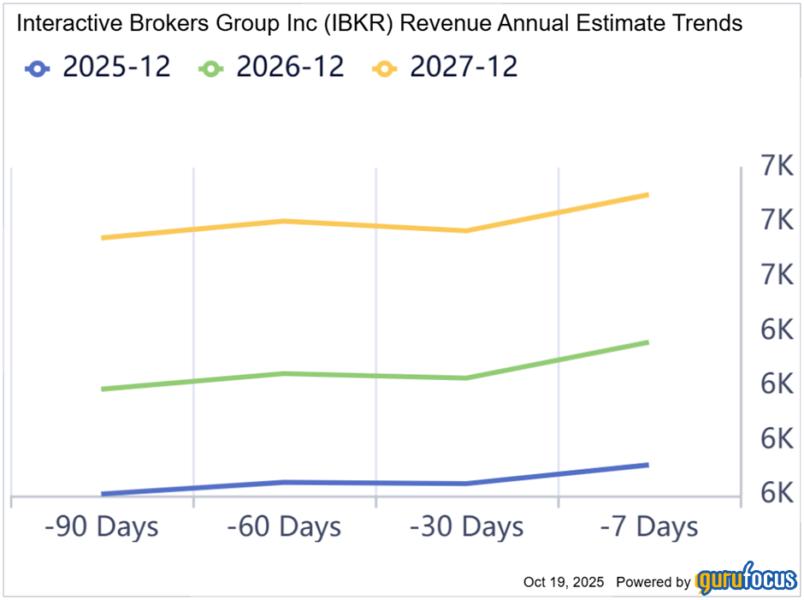

The market is pricing in 16% and 11% revenue growth for the next two years, but I think those projections underestimate the company's momentum. Analyst estimates have already been revised upward over the past 90 days, and I expect that trend to continue.

Source: Gurufocus

As a result, I'm slightly more bullish here and would consider adding on dips or periods of volatility, which this sector never fails to deliver.