Plus500 to Desktop Users: Thanks, But Mobile’s Got This

Nearly nine out of ten contracts for diffrences (CFDs) trades at Plus500 now happen on a phone or tablet — a staggering 89 per cent of the broker’s H1 OTC revenue — compared to an industry average of just 55.5 per cent in Q2 2025. While the overall industry's mobile adoption remains almost stagnant, the Israeli broker's mobile trading share has grown steadily over the past decade, but how did it happen?

Plus500 appears to be an outlier when it comes to mobile trading. In 2024, the broker generated 88 per cent of its OTC revenue from mobile-based trades, with 84 per cent of OTC trades executed from phones or tablets.

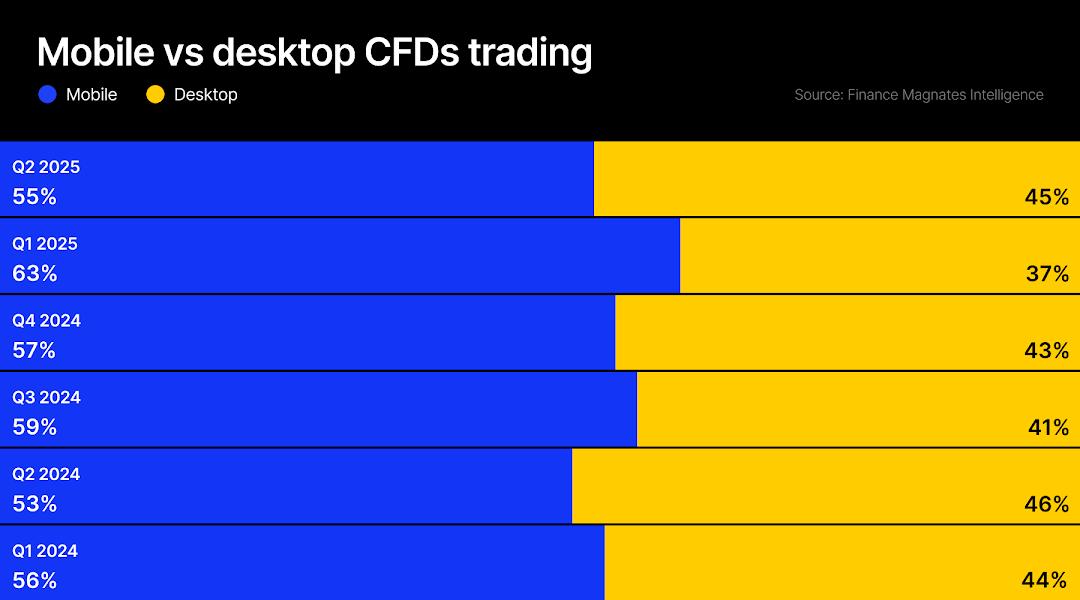

Finance Magnates Intelligence data show that 55.5 per cent of CFDs trades were executed on mobile devices in the second quarter of 2025, compared to 63 per cent in the previous three months.

Read more on Plus500's latest financials: Plus500's Customer Deposits Soar 107% to Record $3.1B in H1 2025

A deep dive into Plus500's historical figures also shows that the broker has always been mobile-first. However, a visible uptick in mobile trading occurred in the post-COVID-19 era.David Zruia, CEO of Plus500

According to figures disclosed in the Israeli broker’s financials, 73 per cent of its OTC trades were on mobile devices in 2018, which jumped to over 79 per cent in 2021 and more than 82 per cent in 2023.

The revenue share from these mobile-based trades also indicates that not only novice traders but also experienced ones are executing trades on smaller screens. The financials of the publicly listed broker revealed that it was generating over 75 per cent of its total revenue from mobile-based trading in 2018, which increased to over 79 per cent in 2020. In 2020, CFDs revenue from mobiles pushed beyond 83 per cent, hitting a record 89 per cent in the first six months of 2025.

Plus500’s Mobile Activities Outshine the Industry

However, the CFD industry's average mobile trading share remains much lower than Plus500’s dominance in the space.

Although almost none of the other brokers share mobile-specific numbers like Plus500, data from Finance Magnates Intelligence show that more traders are now executing trades on mobile apps.

Since 2021, the overall industry share of mobile trading crossed the 60 per cent mark only in Q1 2025.

It should be noted that the industry data compiled by Finance Magnates Intelligence does not represent the whole CFDs market.

A snippet from Finance Magnates Intelligence's latest QIR: Retail FX/CFD Industry Breaks $30 Trillion in Monthly Volume

Then the question arises – why do Plus500 users prefer mobile offerings? The broker has been very vocal about its strategic "mobile-first approach", which was first revealed in its 2024 annual report.

The broker further stated that, due to its "unique system architecture and mobile product offering… every customer interaction is designed to have the same look and feel” across phone, tablet, and web, resulting in very high mobile usage.

Additionally, Plus500 explicitly said its approach is aligned with mobile-centric marketing strategies, and that they “continue to focus on innovation in the mobile and tablet space.”

Smartphone Popularity Pushes CFD Brokers to Apps

CFD brokers became interested in launching mobile apps in the early days of smartphones. Saxo Bank was among the first to launch an iPhone app in 2008, allowing users “to manage fully their positions and orders across multiple asset classes and to check their account.”

Swissquote and City Index were other early adopters of mobile applications, followed by giants like CMC Markets, FXCM, OANDA, and IG Group. Plus500, which now likely dominates mobile trading, launched its iPhone app in 2011.

The two popular third-party forex and CFDs trading platforms, MetaTrader and cTrader, also launched mobile apps in the early days. Several CFDs brokers used these mobile apps for years to enter mobile trading but are now launching their own apps.

Related: GCEX Launches Mobile Trading App for Institutional Crypto and FX Clients

Many are even stuffing their mobile apps with unique features to engage traders.

When it comes to CFDs mobile apps, their popularity can also be correlated with the number of downloads and their rank among others in the category.

With over 10 million downloads, Exness and Plus500 apps lead on Google Play among CFD brokers. eToro also has 10 million downloads, but it has diversified away from CFDs over the years and is now positioning itself as a Robinhood rival.

In the UK, the Trading 212 app ranks number 5 in the finance category on iOS and number 12 on Android. However, Trading 212 is now more focused on trading physical shares than CFDs.

IG Group, which leads the CFDs trading space in the UK, ranks 167th on Apple’s App Store in the country and has over 1 million downloads on Android devices. The Capital.com app outperforms IG with a 134th rank in the UK’s finance category on the App Store and over 5 million downloads on Google Play.