Crypto traders ‘fool themselves’ with price predictions: Peter Brandt

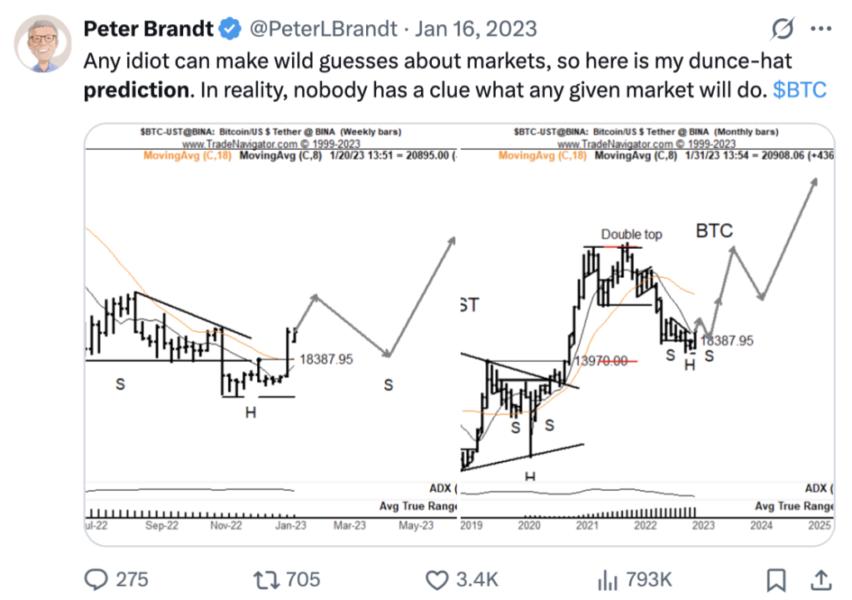

Crypto traders who think they can make accurately price predictions are delusional, says veteran trader Peter Brandt.

Anyone that looks at the charts and tries to tell you where anything is going is actually just kind of fooling themselves, the 79-year-old tells Magazine.

There are a lot of people who will argue with me, of course, Brandt laughs.

Thats not what the chart-lovers on X wannahear after years of doodling lines, and parsing reverse Bart Simpsons and Fibonacci spirals, but Brandt says the only real use of a price chart is seeing where the price has been and where its at now.

In most cases, you can say, probabilistically, a market will pursue the same trend its been with some volatility within a range, he explains.

So the best Brandt or anyone can do with a chart is spot potential asymmetric risks. Give me a point where I can risk $1 and possibly make four, then I dont care whether Im only right half the time or not, he says.

Brandts strong opinions rub some the wrong way, but theres no denying his track record of success.

Hes been around so long, many of Brandts 803,000 X followers were still decades away from being born when he started out trading commodities in 1975.

Over the years since then, Brandt has earned a reputation as one of the most respected chartists in finance. Economist and author Barry Ritholtz even named him among the 30 most influential people in the finance industry.

Who is Peter Brandt?

Surprisingly, Brandt didnt even study finance. He graduated with a journalism degree from the University of Minnesota in 1970 and began his career in advertising, working with major clients like McDonalds. He was even around when Ronald McDonald was created.

A neighbor in the soybean trading business introduced him to the markets, and a few years later, Brandt left behind his promising advertising career to start placing bets on corn.

Yep Brandts been trading corn since the 70s.

Thanks to unpredictable weather and constantly changing agricultural policies, the volatility in that market made it surprisingly profitable.

He later moved on to handling institutional accounts before founding his own proprietary trading firm, Factor Trading Co., which he still operates today. Brandts book, Diary of a Professional Commodity Trader, became Amazons No. 1 trading book for 27 weeks in 2011.

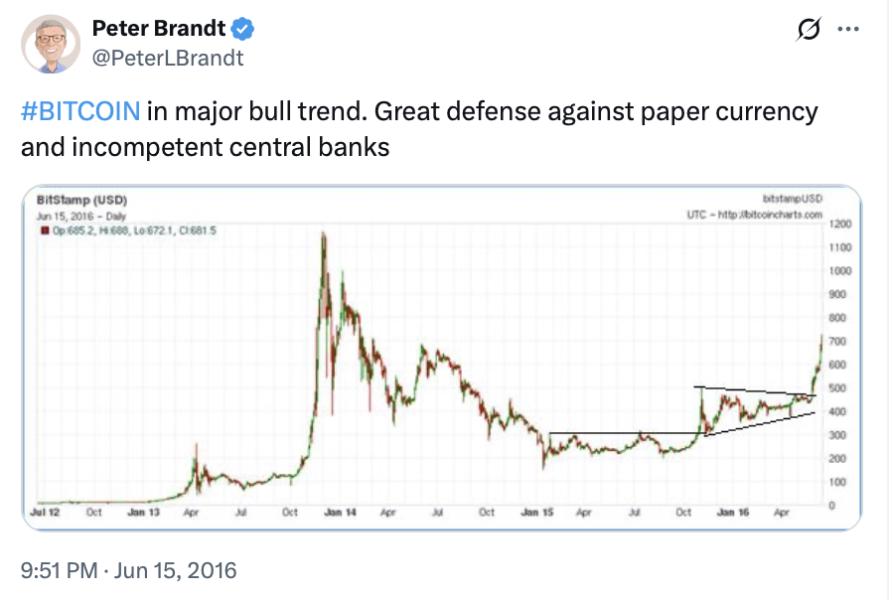

Raoul Pals phone call was Peter Brandts gateway to crypto

Five years after topping the Amazon charts with his trading book, Real Vision CEO Raoul Pal sent him a Bitcoin chart in May 2016, when BTC was trading around $450. The pattern immediately caught Brandts eye.

Raoul sent me a chart saying, Peter, I really appreciate your opinion. What do you think of this chart? I looked at this chart of Bitcoin, I went, Holy, oh, this, this, this thing is sweet.

Brandt immediately called Pal to ask how to buy Bitcoin, admitting he had no clue where to start.

It turned out to be an easy 2X for Brandt, who sold his Bitcoin for around $1,000 in December of that same year.

I thought, man, Im a genius, Brandt says.

Since then, Brandts been calling the tops and bottoms of Bitcoin and other cryptocurrencies, sometimes to the delight, and other times to the frustration, of people in the crypto industry.

Just under two years after that phone call with Pal, in December 2017, Brandt correctly called the top of Bitcoin within a day and predicted an 80% correction, a forecast that eventuated over the following 12 months.

Ill take credit for that call, but Ill take credit for the bad calls too, because Im making those bad calls, he says.

Brandt admits that some of his dramatic predictions are more playful than serious. In June, he floated the idea of a 75% Bitcoin crash, just a month before it hit a new high of $123,100.

Looking back, he says he could probably do a better job of clarifying his sarcastic tone in written posts.

I guess I need to learn. I wish there were an emoji that represented tongue in cheek, Brandt says. I mean, maybe on some I need to put four winks.

In Brandts defense, it wasnt a call with conviction; it was just a thought he threw out there.

Is Bitcoin $BTC following its 2022 script and setting up for a 75% correction? Doesnt hurt to ask this, does it? he said on June 10.

But Brandt doubts well see massive crashes in the future.

I dont think the age of Bitcoin has become institutionalized and accepted to the point where I dont think we see these corrections anymore, he says.

But with half a century of trading, starting three decades before the 2008 Global Financial Crisis, Brandt has seen it all and admits that anything is possible.

To be good at trading, you cant be emotional

Brandt doesnt mind stirring up trouble among ETH and XRP supporters with barbed posts. He says hes an emotionless trader, rather than a fan.

Whether it be Bitcoin or Solana, you name it, there is a price. Its something to be traded. Its not something to be worshiped, he says.

Read also FeaturesHere’s how to keep your crypto safe

Features You dont need to be angry about NFTsIm not afraid to say this is kind of how this particular chart normally will play itself out over time, he adds.

Brandt insists hes just a chartist who isnt afraid to speak his mind when sharing what the charts might be signaling next.

I put these charts up, and if a chart has any sort of negative implication, all of a sudden, Im a hater, he laughs.

But a look at some of his posts suggests its not all neutral or unbiased information. On April 14, he said, ETH is worthless junk, and after the coins price started to rise, Brandt said in a June 10 post, Every dog has its day — woof woof $ETH.

And, after taking years of pot shots at XRP, back in January, Brandt wrote a lengthy post extending an olive branch to XRP holders.

Accept it if you will, reject it if you must, but I offer it with good intent, over the years, I have taken some hard shots at you and your $XRP asset. I admit my rudeness, he said, explaining that XRPs early years of significant drawdowns did not sit well with him.

Brandt says he cant be an XRP and ETH hater if he owns these assets in his crypto wallet, and he openly admits that he owns both.

What I say on Twitter may or may not reflect what Im actually holding in an account, he says.

Brandt says he has a portion of Bitcoin, about 40% of his total holdings, that hes willing to “ride to zero” because he really believes in the Bitcoin narrative, and its Bitcoin that he bought at a much lower price.

Peter Brandt loves trolling the crypto community

Despite initially claiming hes an emotionless trader with no bias, he comes clean and admits he actually likes stirring the pot in the crypto community.

Sometimes I just put things out on Twitter, just to get a response, which I guess is the definition of trolling, he says.

The 79-year-old explains that he needs some way to entertain himself since hes forced to spend much of his life online because of physical disabilities caused by a serious accident back in 1984.

I use a walker when I travel. I use a mobility scooter when I take a walk, or I use a walking stick. I have very little physical mobility anymore, but I do try to get out, Brandt says.

I get bored, and then I have to do something. Then I have to troll, you know. What do I do for fun? Maybe make fun of XRP bulls.

Brandt says the crypto community is particularly susceptible to his trolling because they tend to conflate a persons predictions with their personality.

It seems like the crypto community wants to attribute personality characteristics to anyone who has anything to ever say about any aspect of their favorite chicken, he says.

Brandt thinks hodlers are a bit crazy.

Read also Features NFT collapse and monster egos feature in new Murakami exhibition Features Blockchain is as revolutionary as electricity: Big Ideas with Jason PottsThe idea that youre not a real Bitcoiner unless youre willing to ride out both the highs and the painful lows doesnt sit right with him. 80% drawdowns, for me, are insane, he says.

If someone tells me that theyre all in and theyre willing to sit through 80% drawdown, drawdown after drawdown, quite frankly, theyre going to end up going broke, he adds.

He says the Bitcoin industry is much nastier than the corn industry.

Back when I was a trader in corn, Id go into the corn pit if I was long corn futures and somebody else was short corn futures. I never wanted to attribute negative personality traits to that person; they were just on the other side of the trade for me.

Brandt says Bitcoin purists like to tell him that Bitcoin is a much more sophisticated market than what he was dealing with the charts of corn and sugar dont apply to Bitcoin, but Brandt couldnt disagree more.

If I look at every market I trade, theres been no market that kind of complies with classical charting principles better than Bitcoin. I mean, for me, it has been the ultimate charting market, Brandt says.

Peter Brandt says Bitcoin’s bull run is already well underway

Brandt says were further into the Bitcoin bull run than many people believe, despite the growing sentiment. More people are more bullish at tops than they are at bottoms. More people are more bearish at bottoms, he says.

Thats just how sentiment works. I mean, the price feeds sentiment, and sentiment feeds price, he adds.

Unlike many in the industry, Brandt doesnt view Bitcoin through the lens of the halving cycle. Instead, he focuses on bull market cycles, measuring them from the low of the previous bear market to the peak of the next rally.

By Brandts metric, the current Bitcoin bull market began in November 2022, which means were now approaching the three-year mark. I think thats long in the tooth for a bull market in Bitcoin when you go back over previous cycles, he says.

Brandt explains that each Bitcoin bull cycle has shown what he calls exponential decay in returns compared to the previous one.

He points out that the first bull run saw roughly a 3,200x increase from the bottom to top, the second dropped to around 630x, the third to 122x, and the fourth cycle posted a 21x gain.

He says that with Bitcoin bottoming last cycle at around $15,000, and now having recently reached new highs of $123,100, it is around an 8x move.

So people can say Bitcoin is more bullish than ever. Well, the reality is that is not true.”

Each subsequent bull market cycle in Bitcoin has experienced substantial decay from the previous bull market cycle, Brandt says. He isnt entirely sure how much further Bitcoin can go in this cycle. In May, Brandt said Bitcoin could rise to between $125,000 and $150,000 by August or September.

Given the diminishing returns of each bull cycle, Brandt believes its irresponsible for people to be throwing out $1 million predictions, though he adds thats not to say Bitcoin couldn’t eventually reach that level.

The big question Brandt has in the back of his mind is, what is the fair price of Bitcoin?

Just because we have governments that are in debt, just because we have governments that continue to print money, that doesnt mean Bitcoin needs to go up a million dollars, he says.

Subscribe The most engaging reads in blockchain. Delivered once a week.Email address

SUBSCRIBE