Hello everyone!

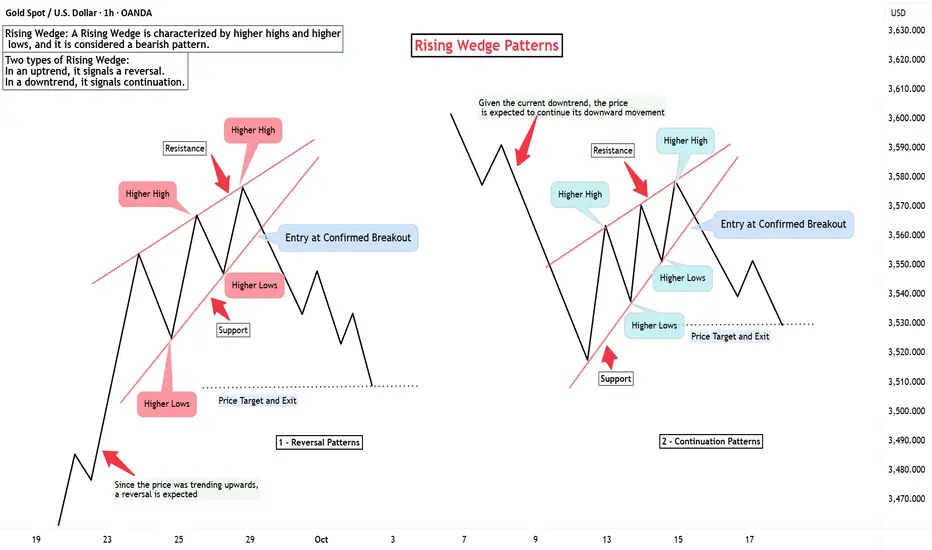

When I first started learning technical analysis, one of the patterns I found incredibly interesting and important was the Rising Wedge pattern. This pattern is formed when the price creates higher highs and higher lows, but the price range gradually narrows. However, there’s something that few people know – the Rising Wedge pattern can appear in two different forms, and each form has significant implications for predicting market trends.

Form 1: Rising Wedge in an Uptrend (Reversal)

The first and most common form of the Rising Wedge is when it appears in an uptrend. This pattern signals that the uptrend is losing momentum. When I identify this pattern, I know the market is weakening and is likely to reverse into a downtrend.

When this pattern forms, I prepare to enter a short trade when the price breaks the support at the bottom of the pattern. This is when the market could start to reverse and move downward.

Form 2: Rising Wedge in a Downtrend (Continuation)

The second form of the Rising Wedge appears in a downtrend. Although it may look similar to the first form, its purpose is different. This pattern does not signal a reversal, but instead indicates that the downtrend will continue after the price breaks below the bottom of the pattern.

In this case, I do not rush to enter a buy trade because this pattern signals that the downtrend is still strong. After the price breaks below the bottom of the pattern, I will consider entering another short trade.

In Summary

The Rising Wedge pattern is an incredibly useful tool for technical analysis to identify changes in price trends. Whether in an uptrend or downtrend, this pattern can provide great trading opportunities if you know how to identify and act on it promptly.

Understanding these two forms helps me make more accurate trading decisions and manage risk more effectively in any market condition.

When I first started learning technical analysis, one of the patterns I found incredibly interesting and important was the Rising Wedge pattern. This pattern is formed when the price creates higher highs and higher lows, but the price range gradually narrows. However, there’s something that few people know – the Rising Wedge pattern can appear in two different forms, and each form has significant implications for predicting market trends.

Form 1: Rising Wedge in an Uptrend (Reversal)

The first and most common form of the Rising Wedge is when it appears in an uptrend. This pattern signals that the uptrend is losing momentum. When I identify this pattern, I know the market is weakening and is likely to reverse into a downtrend.

- Characteristics: The price creates higher highs and higher lows, but the range of price movement narrows, and trading volume typically decreases.

- Confirmation: A breakout below the support at the bottom of the Rising Wedge confirms a trend reversal.

When this pattern forms, I prepare to enter a short trade when the price breaks the support at the bottom of the pattern. This is when the market could start to reverse and move downward.

Form 2: Rising Wedge in a Downtrend (Continuation)

The second form of the Rising Wedge appears in a downtrend. Although it may look similar to the first form, its purpose is different. This pattern does not signal a reversal, but instead indicates that the downtrend will continue after the price breaks below the bottom of the pattern.

- Characteristics: Similar to the pattern in the uptrend, the price also creates higher highs and higher lows, but the price narrowing occurs within a downtrend.

- Confirmation: Once the price breaks below the bottom of the pattern, it is expected to continue the strong downward movement.

In this case, I do not rush to enter a buy trade because this pattern signals that the downtrend is still strong. After the price breaks below the bottom of the pattern, I will consider entering another short trade.

In Summary

The Rising Wedge pattern is an incredibly useful tool for technical analysis to identify changes in price trends. Whether in an uptrend or downtrend, this pattern can provide great trading opportunities if you know how to identify and act on it promptly.

- In an uptrend: The Rising Wedge signals weakness and a potential reversal.

- In a downtrend: The Rising Wedge signals the continuation of the downward trend.

Understanding these two forms helps me make more accurate trading decisions and manage risk more effectively in any market condition.

การนำเสนอที่เกี่ยวข้อง

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

การนำเสนอที่เกี่ยวข้อง

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน