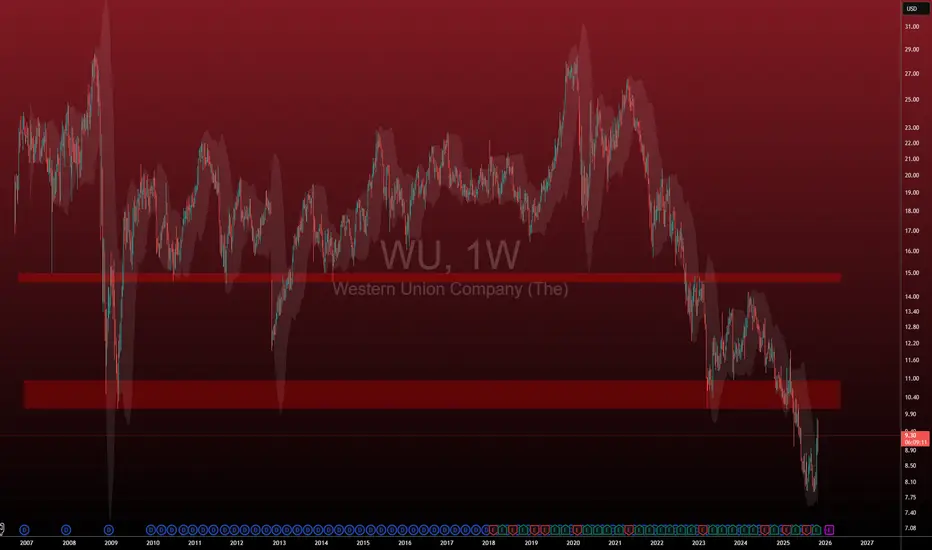

Chart is beaten up. At all time lows. Is it deserved?

Western Union presents a compelling value investment case. The company's valuation metrics appear deeply disconnected from its fundamental performance, trading at a P/E ratio of 3.86 and P/S ratio of 0.86 that would typically suggest severe distress, yet the company maintains exceptional profitability with a 22.2% net income margin and staggering 96.4% return on equity.

The investment thought is strengthened by the company's aggressive capital return program, which has driven 63% EPS growth through an 8.3% reduction in share count. This shareholder friendly approach is complemented by a substantial 8.9% dividend yield, providing both income and growth components to the investment case. While the company faces headwinds including negative revenue growth (-3.4%) and cash flow volatility, these concerns appear adequately discounted at current valuation levels.

From a technical perspective, the stock shows emerging momentum from oversold conditions with RSI at 63, suggesting room for continued recovery within the established $7.85-$11.95 trading range. The combination of deeply discounted valuation, strong profitability, aggressive capital returns, and improving technical positioning creates a compelling risk-reward profile that justifies a BUY recommendation with high conviction.

Western Union presents a compelling value investment case. The company's valuation metrics appear deeply disconnected from its fundamental performance, trading at a P/E ratio of 3.86 and P/S ratio of 0.86 that would typically suggest severe distress, yet the company maintains exceptional profitability with a 22.2% net income margin and staggering 96.4% return on equity.

The investment thought is strengthened by the company's aggressive capital return program, which has driven 63% EPS growth through an 8.3% reduction in share count. This shareholder friendly approach is complemented by a substantial 8.9% dividend yield, providing both income and growth components to the investment case. While the company faces headwinds including negative revenue growth (-3.4%) and cash flow volatility, these concerns appear adequately discounted at current valuation levels.

From a technical perspective, the stock shows emerging momentum from oversold conditions with RSI at 63, suggesting room for continued recovery within the established $7.85-$11.95 trading range. The combination of deeply discounted valuation, strong profitability, aggressive capital returns, and improving technical positioning creates a compelling risk-reward profile that justifies a BUY recommendation with high conviction.

CE - BitDoctor

Access our private indicators and join our Premium Room: bitdoctor.org

Beware of scams - I'll never DM you asking for funds.

Access our private indicators and join our Premium Room: bitdoctor.org

Beware of scams - I'll never DM you asking for funds.

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

CE - BitDoctor

Access our private indicators and join our Premium Room: bitdoctor.org

Beware of scams - I'll never DM you asking for funds.

Access our private indicators and join our Premium Room: bitdoctor.org

Beware of scams - I'll never DM you asking for funds.

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน