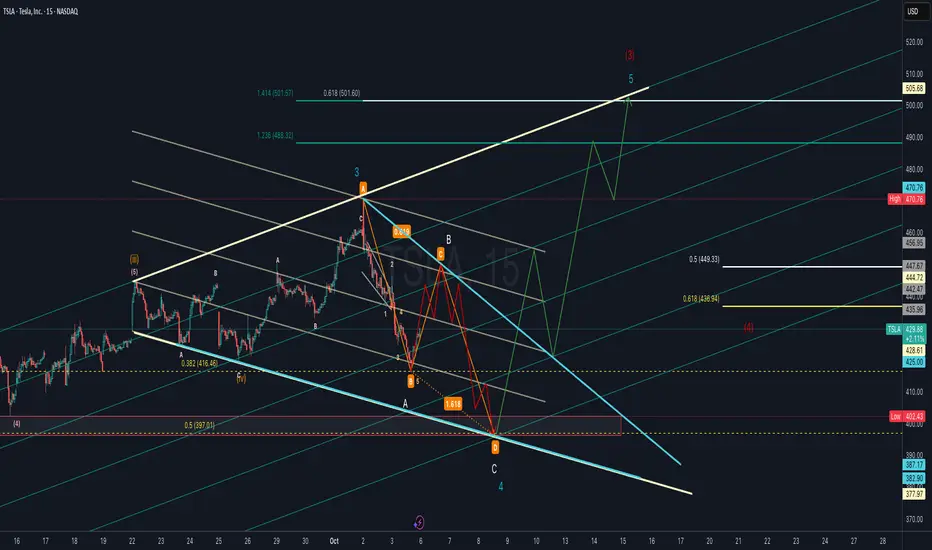

Tesla (TSLA) is forming a potential Wave 4 correction that aligns with an ABC harmonic structure. Price action suggests a possible deeper retracement into the 0.5–0.618 Fibonacci support zone (436–449 area) before resuming its larger uptrend.

If Wave 4 completes near the harmonic “D” zone (highlighted support box), the next leg higher could target the 1.236–1.414 Fibonacci extensions around 488–501, in line with Wave 5 projection.

Key levels to watch:

Support: 436.9 (0.618 retrace), 425 psychological, 397 strong support.

Resistance: 444.7, 470.8 (previous high), 501–505 (Wave 5 target).

Bullish scenario: Wave 4 completes soon, leading to a strong Wave 5 breakout towards 500+.

Bearish scenario: Breakdown below 425–397 support could invalidate the bullish count and extend correction lower.

The other possibility is that it is actually unfolding a flat correction in Wave 4 after completing Wave 3 near the recent high. The structure suggests price may continue to consolidate within the corrective channel before setting up the next impulse leg.

Bullish scenario: Flat correction completes, setting the stage for Wave 5 rally toward 490–505.

Bearish scenario: Breakdown below 397 invalidates the bullish count and signals deeper retracement.

If Wave 4 completes near the harmonic “D” zone (highlighted support box), the next leg higher could target the 1.236–1.414 Fibonacci extensions around 488–501, in line with Wave 5 projection.

Key levels to watch:

Support: 436.9 (0.618 retrace), 425 psychological, 397 strong support.

Resistance: 444.7, 470.8 (previous high), 501–505 (Wave 5 target).

Bullish scenario: Wave 4 completes soon, leading to a strong Wave 5 breakout towards 500+.

Bearish scenario: Breakdown below 425–397 support could invalidate the bullish count and extend correction lower.

The other possibility is that it is actually unfolding a flat correction in Wave 4 after completing Wave 3 near the recent high. The structure suggests price may continue to consolidate within the corrective channel before setting up the next impulse leg.

Bullish scenario: Flat correction completes, setting the stage for Wave 5 rally toward 490–505.

Bearish scenario: Breakdown below 397 invalidates the bullish count and signals deeper retracement.

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน