🟡 1. Chart Title

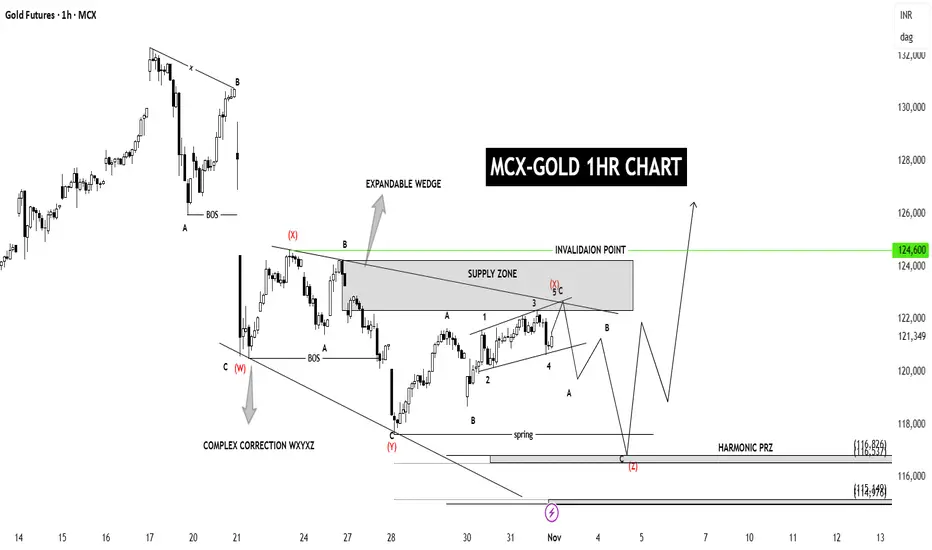

“MCX-GOLD 1HR CHART” — This means the analysis is based on each candle representing 1 hour of price action.

⸻

⚙ 2. Structure Breakdown

• Complex Correction (W–X–Y–X–Z):

This shows that gold has been in a corrective phase, not an impulsive move.

The correction is labeled as a WXYXZ structure — a complex sideways/downward correction with multiple swings.

• Expandable Wedge:

The pattern shows an expanding shape, meaning each swing is getting slightly larger.

This is a sign of high volatility and often forms before a major breakout.

⸻

⚫ 3. Key Zones

• Supply Zone (around ₹124,000–₹124,600):

This is where sellers are expected to enter the market, possibly pushing the price down again.

• Invalidation Point (₹124,600):

If the price goes above ₹124,600, this current bearish correction view is invalidated, and a bullish breakout could start.

• Harmonic PRZ (Potential Reversal Zone):

Located around ₹116,800 – ₹113,400, marked at the bottom of the chart.

This is a buy zone (demand area) based on harmonic projection — expecting the price to reverse upward from this region.

⸻

🔁 4. Elliott Wave Labels

• Current correction labeled as Wave (4) —

After completion, a strong Wave (5) impulse upward is expected.

• Sub-waves (a–b–c) are drawn within the correction to show smaller internal movements.

⸻

📉 5. Expected Move

The chart shows two possible paths:

1. Short-term bearish move —

Price may fall from the supply zone (~₹122,000–₹124,000) to the harmonic PRZ around ₹117,000.

2. Then bullish reversal —

From the PRZ, the chart expects a strong upside rally, possibly toward ₹126,000+.

“MCX-GOLD 1HR CHART” — This means the analysis is based on each candle representing 1 hour of price action.

⸻

⚙ 2. Structure Breakdown

• Complex Correction (W–X–Y–X–Z):

This shows that gold has been in a corrective phase, not an impulsive move.

The correction is labeled as a WXYXZ structure — a complex sideways/downward correction with multiple swings.

• Expandable Wedge:

The pattern shows an expanding shape, meaning each swing is getting slightly larger.

This is a sign of high volatility and often forms before a major breakout.

⸻

⚫ 3. Key Zones

• Supply Zone (around ₹124,000–₹124,600):

This is where sellers are expected to enter the market, possibly pushing the price down again.

• Invalidation Point (₹124,600):

If the price goes above ₹124,600, this current bearish correction view is invalidated, and a bullish breakout could start.

• Harmonic PRZ (Potential Reversal Zone):

Located around ₹116,800 – ₹113,400, marked at the bottom of the chart.

This is a buy zone (demand area) based on harmonic projection — expecting the price to reverse upward from this region.

⸻

🔁 4. Elliott Wave Labels

• Current correction labeled as Wave (4) —

After completion, a strong Wave (5) impulse upward is expected.

• Sub-waves (a–b–c) are drawn within the correction to show smaller internal movements.

⸻

📉 5. Expected Move

The chart shows two possible paths:

1. Short-term bearish move —

Price may fall from the supply zone (~₹122,000–₹124,000) to the harmonic PRZ around ₹117,000.

2. Then bullish reversal —

From the PRZ, the chart expects a strong upside rally, possibly toward ₹126,000+.

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน