Hello dear traders🙋🏻; I'm Pejman & this is the "How to get fish from channels" class. I guess you've heard, "Give a man a fish, and you feed him for a day🍣; teach a man to fish🎣, and you feed him for a lifetime."

Like every other educational post, today I will teach you how to fish and make money from the Market River🏞️.

As you know, fishing requires patience and practice, and you also have to take risks and throw bait into the water⛲. But today, together, we can use all kinds of price channels that are formed in this attractive river as a fishing net.🕸️

Our tool for fishing in the market river is technical analysis, which we discussed in previous posts. You can refer to this post and pick up your fishing rod.

You must have noticed that in the financial markets, the prices have their patterns and trends, which help us to catch the best fish🐠.

These patterns and specific price movements cause various trends in the market, which I explained in the market types post.

Another feature of specific price patterns and trends is the creation of price channels. Of course, don't get me wrong, I don't mean TV channels📺.

Although these channels are as attractive as sports channels and watching the Barcelona and Real Madrid games⚽🏟️, they have other features besides attractiveness✨.

They help you to predict the area of price movement even for the future. But please don't confuse channels with a magic 8-ball🎱. Based on past trends, they can give you a sense of where the price may be headed👀.

Trading without a price channel is like fishing without a net🕸️; you just guess.🤔 So, let's check the channels more closely and catch fish from them until the river is wavy.🌊

First, we need to know what the channel is.🤷🏻

Channels are like riverbanks that guide water flow, except, in this case, the channels guide the flow of candlesticks.🕯️

Price channels are made when the price is under the pressure of two ranges of supply and demand.

A channel is a trading range between two trend lines in which the price of an asset moves in almost predictable directions💁🏻. A price channel is like a trend line with a friend; two are always better than one, right?🧑🏻🤝🧑🏻

They also say: "The trend is your friend, but the price channel is your guide🙏🏻." By drawing the channels, you can find the possible price path🛣️, and at the right time, your hook will be stuck on sweet and big dollars💰.

Channels can be formed and used in any market with trending price changes, from stocks to forex and cryptocurrencies.

Channels, like many other tools in this market, have different types. Put down your fishing rods and put on your swimsuits🩲👙; we have to dive into the next topic.🏊🏻♀️

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Dear students welcome to the types of channels class.🧑🏻🏫

The first lesson is ascending channels.⬆️

The ascending channel for the price is like a staircase to heaven!

An ascending channel is the same as an upward trend line, with the difference that in addition to the aligned valleys🌄, the peaks⛰️ are also aligned and are formed parallel to the valleys. Both the peaks and valleys will be predictable.💁🏻

Of course, you cannot be sure what the next price move will be, but you can predict many possibilities.👀

Now that we climbed the stairs and got acquainted with the ascending channel, it is time to get acquainted with the descending channel⬇️ and do some skiing⛷️. They say: In the deepest water is the best fishing. So let's swim deeper and get to know the descending channel.🤿

The descending channel is like a waterfall, pulling down everything in its path. Candles are no exception, and when they are in a descending channel, they slide like fish🐠 in a waterfall and go lower and lower.

Look for a series of Lower Highs(LH) and Lower Lows(LL) to identify descending channels.

The difference between ascending and descending channels is similar to climbing🧗🏻 and skiing⛷️; Descending channels push the price down and cause lower peaks and valleys.

If you were trading in one-sided markets and encountered a descending channel, my friend, just sell and run🏃🏻. But if you were in two-sided markets, you can enjoy taking short positions🔻 and fishing in this drop.🎣

The noteworthy point✨ is that the longer a channel is and the more times⏳ the price has hit any side of this channel, the more essential and reliable this channel becomes.✅

But what if the price is too tired to climb the stairs🔺😩 and not in a good mood to play on the slide🔻😒?

In this case, it will be stuck between two✌🏻 horizontal trend lines and form a range or sideway channel.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Range channels are just like ponds. There is no exceptional water flow🌊 in a pond, and fish and other creatures can only Move inside this pond. But range channels could be more attractive and eye-catching, like ponds.🌟

Range channels make traders tired.🙍🏻 Because trading in these channels will be more difficult than in other channels, it is challenging to recognize price movements or profit from small price movements in range channels.🤷🏻

The range channel is not similar to the ascending or descending channel. Because as its name suggests, it does not have a particular trend at all and is trendless.

When the price is in a channel range, the number of buyers🟢 and sellers🔴 is almost equal, and supply and demand are virtually identical.

🙅🏻Unlike ascending and descending channels, no peaks or valleys can be seen in a range channel higher or lower than its previous peaks or valleys.

Range channel is created by considering two trend lines from one peak to another peak and from one valley to another valley.

👌🏻Actually, the difference between a range channel and other channels is that these peaks and valleys are equal and basically in the same direction.

These channels may be permanent for river fishes🐟 and have become their home🏡, but there is no permanent channel or trend line for candles.😉

Remember that candles can leave their channel just like a bird🕊️ that jumps out of its cage or a prisoner escaping prison.🏃🏻

Do you remember in the previous posts when I talked about support and resistance lines, we said that candles could finally be released from their support or resistance prison? This case is the same.💁🏻✅

If you forget or don't know about support and resistance lines, take a breath and read this post before going to the next steps.👇🏻

The longer a channel is and the longer the price is locked in it🔒, the pressure of supply and demand on the price is more significant, and you will probably see a strong movement of the candles after the failure.💪🏻

But don't worry. You can still make money trading channels and even breakouts. In the following steps👣, I will teach you how to trade with all types of channels, as well as how to trade in breakouts.😉

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Now you must have questions about how to draw channels.🤷🏻

Well, obviously, with a very sharp pencil✏️ and a steady hand✍🏻. Just kidding😅, you must first recognize the trend and look for regular price movements to draw channels.

To catch a good fish, you must patiently monitor the price movements and look for peaks and valleys that move in the same direction.🕵🏻

You will find your channel by connecting these peaks and the valleys to each other. You need at least two✌🏻 parallel peaks and two valleys to draw a channel.

But how do you know that a channel has been drawn correctly?🤔 Channels have conditions, my friend. I wrote these conditions, so pay attention when drawing the channel.😊

When you draw your channel, make sure that the upper and lower lines of the channel must be parallel.

If the two channel lines are not parallel and are angled, this is a sign of your terrible drawing🤦🏻♀️. What kind of school🏫 did you go to where you can't draw two parallel lines?😐

I'm kidding😄, but if this happens, the pattern is no longer a trend channel but a triangle, which I discussed in previous posts.

Channels and trend lines create patterns by forming different shapes, which I explained in the above post.

I said the lines should be parallel but don't take a ruler📏 to measure each channel and trend line. There is nothing quite like books, my friend.😉

According to the definitions, don't expect to always find a channel 100%. In that case, you will lag behind the whole market.🙅🏻

But there is a tool with the help of which you can draw your channels correctly and lower your error percentage. ✅You can find this expression from the toolbar beside your TradingView charts. Who doesn't like to cheat sometimes?

Look to the left of your charts and click on the second one from the top. New options are displayed; the fifth option from the bottom is the Parallel Channel.

Select this tool and look at your chart. Use this tool wherever you can draw a channel.

To draw ascending channels, you have to find two valleys with a peak between them and you can look for the second peak by drawing the parallel channel. And vice versa, to draw descending channels, you must look for two peaks with a valley between them.

If you found two valleys and there were no peaks between them, something must be wrong & you should reconsider to find the right points.

Finally, the task of the range channels is also straightforward🙂 When you start drawing, from peak to peak or valley to valley, the range channel will show itself, and it will not be different.😊

By default, parallel channels are also a middle line.👀

The middle line is like a negotiator between the other two lines. When the price moves from the upper band of a channel to the bottom, the middle line can mediate and supports the price.🟢

Or when the price moves from the lower band of a channel to the top, the middle line can prevent the price from moving further.🚫

Dear students🧑🏻🏫, now you have acquired the necessary skills, and it is time to take your sticks🪝 and come with me to the river.

Before you trade and catch fish yourself, pay attention🙏🏻 to the positions I took with the help of channels to gain skills in this field because a poor worker blames his tools.

There are ✌🏻two strategies for trading using channels, both of which I will teach you.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

For example, in an ascending channel, such as trading with a support line, you can buy🟢 when the price is on the lower line of the channel and wait for it to reach the upper line of the channel and exit the positioning 🔚.

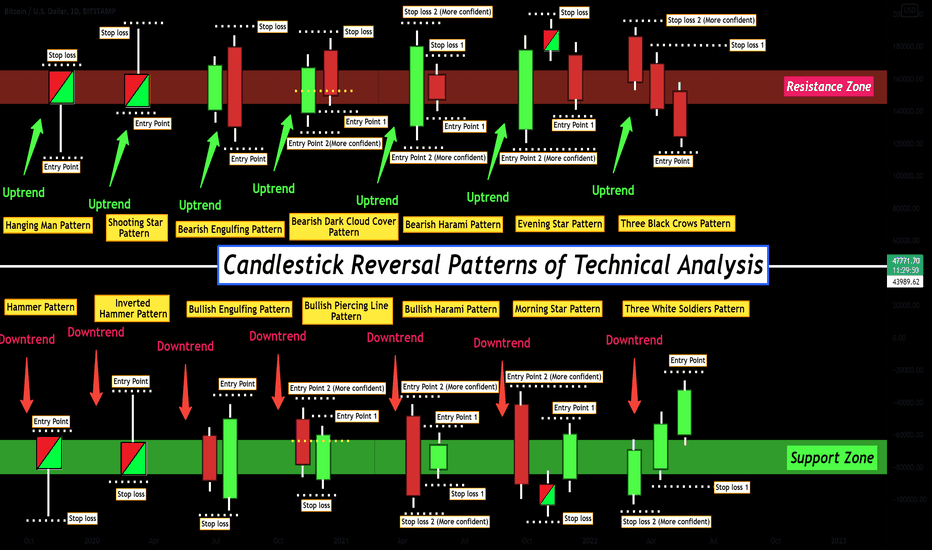

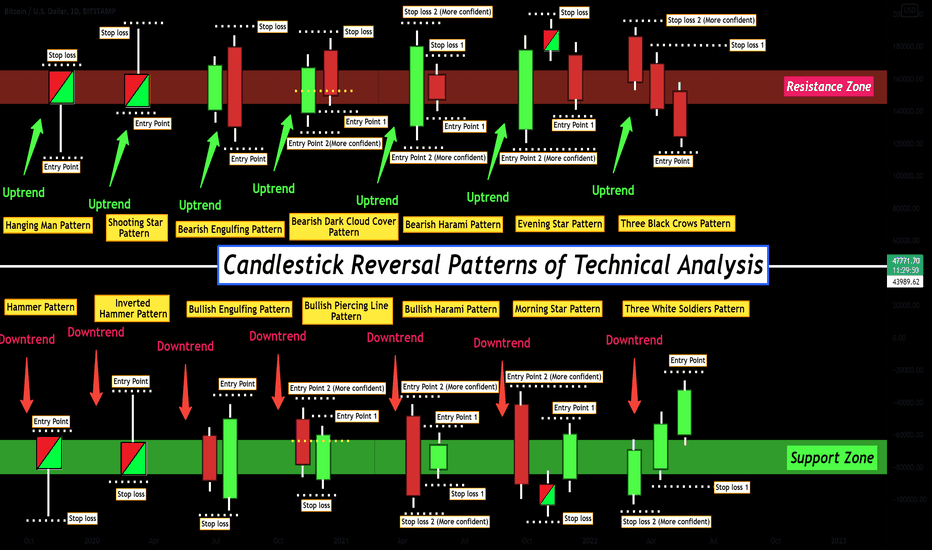

In previous articles, we talked about candlestick patterns. Using these patterns, you can get help to enter and exit your positions.

You can place your stop loss below the bottom line of the channel. You must indeed lose a fly to catch a trout.🎣 But always remember to be careful.😉

They say to invest what you can afford to lose. But remember to manage your Risk-Ratio and only trade after practicing and testing your strategies several times.✅

Indeed, even if the channel is downward🔻, you should only trade in the direction of the trend; as soon as the price reaches the upper line or resistance line, enter the position and take your profit💲 when you get the lower line of the channel.

Of course, if you are facing a range channel, your general strategy should be to buy at the bottom and sell at the top of the channel, and it's like eating a piece of cake.🍰👌🏻

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

When the price is stuck in a channel, is it like a prisoner who can't guess whether he will finally escape by digging a tunnel or climbing over the prison walls? It is impossible to know from which side the price will eventually break its channel.🤷🏻

It seems that channels usually break against the direction of their slope, but it is always possible for a channel to break on both sides.😉 If a channel is broken, the price usually starts a significant move in the same direction as the break.🏃🏻

Did I say that the more the price is locked in a channel, the stronger it will move?💪🏻 Usually, the price can move according to the width of its channel.

When the price is stuck in a channel, is it like a prisoner who can't guess whether he will finally escape by digging a tunnel or climbing over the prison walls? It is impossible to know from which side the price will eventually break its channel.🤷🏻

It seems that channels usually break against the direction of their slope, but it is always possible for a channel to break on both sides.😉 If a channel is broken, the price usually starts a significant move in the same direction as the break.🏃🏻

Did I say that the more the price is locked in a channel, the stronger it will move?💪🏻 Usually, the price can move according to the width of its channel.

You can even use both strategies to trade channels.👌🏻 For example, if the price is locked in this channel, trade in the direction of the channel trend.

Breaking channels is like breaking trend lines or support & resistance, and it comes with a breakout candle🚩 and a confirmation candle✅.

After the breakout, if you have an open position in the trend direction of the channel, you should close it.🙅🏻

After seeing the confirmation✅ of the breakout, enter the position according to your trading strategy and follow the risk management points.

For example, I would have ✌🏻two entry points. And I place my stop loss slightly above the breakout candle🔴.

My first point of entry is after seeing the confirmation candle. And if the price returns🔁 to its channel for the last kiss💋, I activate my second entry point. This will reduce my Risk-Ratio, and I will have a safer position.

To know that your channels are ending🔚, you should look for signs of weakness in price movements; for example, in an ascending channel, breaking below the low trend line or failing to reach higher peaks are signs of weakness.

It's like the price is taking a break before going higher again.

The last thing I'd like to tell you is don't try to force a price on a channel when it doesn't exist. Remember, patience is vital, and it is better to lose a trade than accept a losing trade. As said: "Sometimes the best catches are found in still waters." 🎣

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Conclusion:

Price channels are the rails that keep asset prices on track.🛤️ Just like fishing in a river, trading requires patience, skill, and an understanding of your environment. Check and avoid being affected by market fluctuations.🙅🏻

Now you can take your fishing rod🎣. Whether you are fishing in a bullish, bearish, or range market, the right approach and tools can help you make big profits.😉💲

Remember that profit and loss are together. Profits are never permanent and remember that a bad day at fishing is better than a good day at work. Am I right?😊

For you to have more good trading days than bad days, remember that it's okay to make mistakes when drawing🖌️ those price channels.

You can make up for all your mistakes by practicing and finding the right strategy. Warren Buffett says: The best investment you can make is your abilities.💪🏻

Feel free to experiment and try new strategies.✨ Don't be like a fish out of water; use the channels for swimming🏊🏻♀️ towards the market river.

Remember what Jesse Livermore said: "Price channels are like guardrails on the highway🚧 - they keep you from going off track and help you stay on track."

This post is over, but the road to the technical analysis journey is not over🧳✈️. In the following posts, I will accompany you step by step👣 and teach you other tools.

Be healthy🙏🏻, profitable💲, and successful!✌🏻

Ask your questions in the comments💬 and share your opinions with me😍.

Like every other educational post, today I will teach you how to fish and make money from the Market River🏞️.

As you know, fishing requires patience and practice, and you also have to take risks and throw bait into the water⛲. But today, together, we can use all kinds of price channels that are formed in this attractive river as a fishing net.🕸️

Our tool for fishing in the market river is technical analysis, which we discussed in previous posts. You can refer to this post and pick up your fishing rod.

You must have noticed that in the financial markets, the prices have their patterns and trends, which help us to catch the best fish🐠.

These patterns and specific price movements cause various trends in the market, which I explained in the market types post.

Another feature of specific price patterns and trends is the creation of price channels. Of course, don't get me wrong, I don't mean TV channels📺.

Although these channels are as attractive as sports channels and watching the Barcelona and Real Madrid games⚽🏟️, they have other features besides attractiveness✨.

They help you to predict the area of price movement even for the future. But please don't confuse channels with a magic 8-ball🎱. Based on past trends, they can give you a sense of where the price may be headed👀.

Trading without a price channel is like fishing without a net🕸️; you just guess.🤔 So, let's check the channels more closely and catch fish from them until the river is wavy.🌊

First, we need to know what the channel is.🤷🏻

Channels are like riverbanks that guide water flow, except, in this case, the channels guide the flow of candlesticks.🕯️

Price channels are made when the price is under the pressure of two ranges of supply and demand.

A channel is a trading range between two trend lines in which the price of an asset moves in almost predictable directions💁🏻. A price channel is like a trend line with a friend; two are always better than one, right?🧑🏻🤝🧑🏻

They also say: "The trend is your friend, but the price channel is your guide🙏🏻." By drawing the channels, you can find the possible price path🛣️, and at the right time, your hook will be stuck on sweet and big dollars💰.

Channels can be formed and used in any market with trending price changes, from stocks to forex and cryptocurrencies.

Channels, like many other tools in this market, have different types. Put down your fishing rods and put on your swimsuits🩲👙; we have to dive into the next topic.🏊🏻♀️

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Dear students welcome to the types of channels class.🧑🏻🏫

The first lesson is ascending channels.⬆️

The ascending channel for the price is like a staircase to heaven!

An ascending channel is the same as an upward trend line, with the difference that in addition to the aligned valleys🌄, the peaks⛰️ are also aligned and are formed parallel to the valleys. Both the peaks and valleys will be predictable.💁🏻

Of course, you cannot be sure what the next price move will be, but you can predict many possibilities.👀

Now that we climbed the stairs and got acquainted with the ascending channel, it is time to get acquainted with the descending channel⬇️ and do some skiing⛷️. They say: In the deepest water is the best fishing. So let's swim deeper and get to know the descending channel.🤿

The descending channel is like a waterfall, pulling down everything in its path. Candles are no exception, and when they are in a descending channel, they slide like fish🐠 in a waterfall and go lower and lower.

Look for a series of Lower Highs(LH) and Lower Lows(LL) to identify descending channels.

The difference between ascending and descending channels is similar to climbing🧗🏻 and skiing⛷️; Descending channels push the price down and cause lower peaks and valleys.

If you were trading in one-sided markets and encountered a descending channel, my friend, just sell and run🏃🏻. But if you were in two-sided markets, you can enjoy taking short positions🔻 and fishing in this drop.🎣

The noteworthy point✨ is that the longer a channel is and the more times⏳ the price has hit any side of this channel, the more essential and reliable this channel becomes.✅

But what if the price is too tired to climb the stairs🔺😩 and not in a good mood to play on the slide🔻😒?

In this case, it will be stuck between two✌🏻 horizontal trend lines and form a range or sideway channel.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Range channels are just like ponds. There is no exceptional water flow🌊 in a pond, and fish and other creatures can only Move inside this pond. But range channels could be more attractive and eye-catching, like ponds.🌟

Range channels make traders tired.🙍🏻 Because trading in these channels will be more difficult than in other channels, it is challenging to recognize price movements or profit from small price movements in range channels.🤷🏻

The range channel is not similar to the ascending or descending channel. Because as its name suggests, it does not have a particular trend at all and is trendless.

When the price is in a channel range, the number of buyers🟢 and sellers🔴 is almost equal, and supply and demand are virtually identical.

🙅🏻Unlike ascending and descending channels, no peaks or valleys can be seen in a range channel higher or lower than its previous peaks or valleys.

Range channel is created by considering two trend lines from one peak to another peak and from one valley to another valley.

👌🏻Actually, the difference between a range channel and other channels is that these peaks and valleys are equal and basically in the same direction.

These channels may be permanent for river fishes🐟 and have become their home🏡, but there is no permanent channel or trend line for candles.😉

Remember that candles can leave their channel just like a bird🕊️ that jumps out of its cage or a prisoner escaping prison.🏃🏻

Do you remember in the previous posts when I talked about support and resistance lines, we said that candles could finally be released from their support or resistance prison? This case is the same.💁🏻✅

If you forget or don't know about support and resistance lines, take a breath and read this post before going to the next steps.👇🏻

The longer a channel is and the longer the price is locked in it🔒, the pressure of supply and demand on the price is more significant, and you will probably see a strong movement of the candles after the failure.💪🏻

But don't worry. You can still make money trading channels and even breakouts. In the following steps👣, I will teach you how to trade with all types of channels, as well as how to trade in breakouts.😉

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Now you must have questions about how to draw channels.🤷🏻

Well, obviously, with a very sharp pencil✏️ and a steady hand✍🏻. Just kidding😅, you must first recognize the trend and look for regular price movements to draw channels.

To catch a good fish, you must patiently monitor the price movements and look for peaks and valleys that move in the same direction.🕵🏻

You will find your channel by connecting these peaks and the valleys to each other. You need at least two✌🏻 parallel peaks and two valleys to draw a channel.

But how do you know that a channel has been drawn correctly?🤔 Channels have conditions, my friend. I wrote these conditions, so pay attention when drawing the channel.😊

When you draw your channel, make sure that the upper and lower lines of the channel must be parallel.

If the two channel lines are not parallel and are angled, this is a sign of your terrible drawing🤦🏻♀️. What kind of school🏫 did you go to where you can't draw two parallel lines?😐

I'm kidding😄, but if this happens, the pattern is no longer a trend channel but a triangle, which I discussed in previous posts.

Channels and trend lines create patterns by forming different shapes, which I explained in the above post.

I said the lines should be parallel but don't take a ruler📏 to measure each channel and trend line. There is nothing quite like books, my friend.😉

According to the definitions, don't expect to always find a channel 100%. In that case, you will lag behind the whole market.🙅🏻

But there is a tool with the help of which you can draw your channels correctly and lower your error percentage. ✅You can find this expression from the toolbar beside your TradingView charts. Who doesn't like to cheat sometimes?

Look to the left of your charts and click on the second one from the top. New options are displayed; the fifth option from the bottom is the Parallel Channel.

Select this tool and look at your chart. Use this tool wherever you can draw a channel.

To draw ascending channels, you have to find two valleys with a peak between them and you can look for the second peak by drawing the parallel channel. And vice versa, to draw descending channels, you must look for two peaks with a valley between them.

If you found two valleys and there were no peaks between them, something must be wrong & you should reconsider to find the right points.

Finally, the task of the range channels is also straightforward🙂 When you start drawing, from peak to peak or valley to valley, the range channel will show itself, and it will not be different.😊

By default, parallel channels are also a middle line.👀

The middle line is like a negotiator between the other two lines. When the price moves from the upper band of a channel to the bottom, the middle line can mediate and supports the price.🟢

Or when the price moves from the lower band of a channel to the top, the middle line can prevent the price from moving further.🚫

Dear students🧑🏻🏫, now you have acquired the necessary skills, and it is time to take your sticks🪝 and come with me to the river.

Before you trade and catch fish yourself, pay attention🙏🏻 to the positions I took with the help of channels to gain skills in this field because a poor worker blames his tools.

There are ✌🏻two strategies for trading using channels, both of which I will teach you.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

For example, in an ascending channel, such as trading with a support line, you can buy🟢 when the price is on the lower line of the channel and wait for it to reach the upper line of the channel and exit the positioning 🔚.

In previous articles, we talked about candlestick patterns. Using these patterns, you can get help to enter and exit your positions.

You can place your stop loss below the bottom line of the channel. You must indeed lose a fly to catch a trout.🎣 But always remember to be careful.😉

They say to invest what you can afford to lose. But remember to manage your Risk-Ratio and only trade after practicing and testing your strategies several times.✅

Indeed, even if the channel is downward🔻, you should only trade in the direction of the trend; as soon as the price reaches the upper line or resistance line, enter the position and take your profit💲 when you get the lower line of the channel.

Of course, if you are facing a range channel, your general strategy should be to buy at the bottom and sell at the top of the channel, and it's like eating a piece of cake.🍰👌🏻

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

When the price is stuck in a channel, is it like a prisoner who can't guess whether he will finally escape by digging a tunnel or climbing over the prison walls? It is impossible to know from which side the price will eventually break its channel.🤷🏻

It seems that channels usually break against the direction of their slope, but it is always possible for a channel to break on both sides.😉 If a channel is broken, the price usually starts a significant move in the same direction as the break.🏃🏻

Did I say that the more the price is locked in a channel, the stronger it will move?💪🏻 Usually, the price can move according to the width of its channel.

When the price is stuck in a channel, is it like a prisoner who can't guess whether he will finally escape by digging a tunnel or climbing over the prison walls? It is impossible to know from which side the price will eventually break its channel.🤷🏻

It seems that channels usually break against the direction of their slope, but it is always possible for a channel to break on both sides.😉 If a channel is broken, the price usually starts a significant move in the same direction as the break.🏃🏻

Did I say that the more the price is locked in a channel, the stronger it will move?💪🏻 Usually, the price can move according to the width of its channel.

You can even use both strategies to trade channels.👌🏻 For example, if the price is locked in this channel, trade in the direction of the channel trend.

Breaking channels is like breaking trend lines or support & resistance, and it comes with a breakout candle🚩 and a confirmation candle✅.

After the breakout, if you have an open position in the trend direction of the channel, you should close it.🙅🏻

After seeing the confirmation✅ of the breakout, enter the position according to your trading strategy and follow the risk management points.

For example, I would have ✌🏻two entry points. And I place my stop loss slightly above the breakout candle🔴.

My first point of entry is after seeing the confirmation candle. And if the price returns🔁 to its channel for the last kiss💋, I activate my second entry point. This will reduce my Risk-Ratio, and I will have a safer position.

To know that your channels are ending🔚, you should look for signs of weakness in price movements; for example, in an ascending channel, breaking below the low trend line or failing to reach higher peaks are signs of weakness.

It's like the price is taking a break before going higher again.

The last thing I'd like to tell you is don't try to force a price on a channel when it doesn't exist. Remember, patience is vital, and it is better to lose a trade than accept a losing trade. As said: "Sometimes the best catches are found in still waters." 🎣

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Conclusion:

Price channels are the rails that keep asset prices on track.🛤️ Just like fishing in a river, trading requires patience, skill, and an understanding of your environment. Check and avoid being affected by market fluctuations.🙅🏻

Now you can take your fishing rod🎣. Whether you are fishing in a bullish, bearish, or range market, the right approach and tools can help you make big profits.😉💲

Remember that profit and loss are together. Profits are never permanent and remember that a bad day at fishing is better than a good day at work. Am I right?😊

For you to have more good trading days than bad days, remember that it's okay to make mistakes when drawing🖌️ those price channels.

You can make up for all your mistakes by practicing and finding the right strategy. Warren Buffett says: The best investment you can make is your abilities.💪🏻

Feel free to experiment and try new strategies.✨ Don't be like a fish out of water; use the channels for swimming🏊🏻♀️ towards the market river.

Remember what Jesse Livermore said: "Price channels are like guardrails on the highway🚧 - they keep you from going off track and help you stay on track."

This post is over, but the road to the technical analysis journey is not over🧳✈️. In the following posts, I will accompany you step by step👣 and teach you other tools.

Be healthy🙏🏻, profitable💲, and successful!✌🏻

Ask your questions in the comments💬 and share your opinions with me😍.

บันทึก

Thanks for reading this lesson; the next lesson is Bull and Bear Traps🌹👍🙏บันทึก

If you have experience trading by channels, please share it with me; thanks.🙏🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

การนำเสนอที่เกี่ยวข้อง

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

การนำเสนอที่เกี่ยวข้อง

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน