🚀 Breakout Stock Alert: BASF India Ltd (BASF)

📌 Price: ₹4,902.90 📊 Volume: 138.03K 📅 Date: 19-05-2025

① Pattern Name, Timeframe, Structure & Explanation

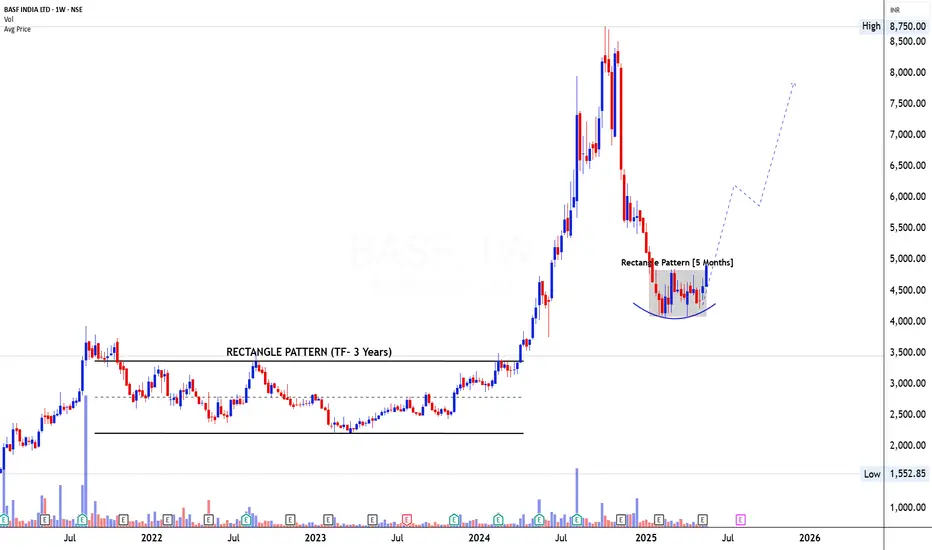

Daily Timeframe: Rectangle Base Pattern (5 Months)

Weekly Timeframe: Base Formation in Uptrend

On the daily chart, BASF has been coiling inside a rectangle consolidation pattern between ₹4,300–₹4,800 for nearly 5 months. The base is tight, with volatility compression and a subtle rounding shape at the lower support, hinting at accumulation. The recent breakout from this rectangle comes on the back of strong bullish action with increasing range and volume — indicating supply absorption and demand dominance.

On the weekly chart, this move gains even more significance. BASF had spent nearly 3 years (2021–2023) inside a broad rectangle, eventually giving a massive upside breakout in 2024. The recent pullback post-highs around ₹8,750 has now rounded out into a basing structure — potentially forming the right side of a new base, suggesting a continuation of the broader uptrend.

② Volume Formation (During Pattern, Breakout, and Retest)

Daily Timeframe: Volume remained muted within the rectangle, showing lack of interest during the base — a common trait in high-quality accumulation phases. The breakout candle on 19 May shows volume spike to 138K, far above the base average, confirming institutional buying interest.

Weekly Timeframe: Volume clearly dried up during the correction phase post-2024 top, and has now started building up again as price reclaims previous support-turned-base zones.

③ Breakout Candlestick, Follow-Through & Trap Behavior

Breakout Candle (Daily): A wide-range, full-bodied bullish candle with gap-up characteristics and a +7.2% move, backed by a sharp volume surge — textbook breakout behavior

Follow-Through Watch: The stock may now retest the breakout zone of ₹4,750–₹4,800. A low-volume pullback would offer a healthy re-entry.

Trap Behavior: No signs of fakeouts or premature breakdowns. The rectangle was tight and clean — this breakout appears genuine and well-structured.

④ Trade Explanation (Entry, Target, Stop-loss, Risk\:Reward)

Entry Zone: ₹4,880–₹4,950 (near breakout close or minor dip)

Stop-loss: ₹4,600 (below rectangle low and base support)

*Target Zone: ₹6,200 (initial), ₹7,200–₹7,500 (long-term structure)

📏 Measured Move (Rectangle Range):

Range = ₹4,800 - ₹4,300 = ₹500

Target = ₹4,800 + ₹500 = ₹5,300 (short-term)

But considering weekly rounding base, extended moves toward ₹6,200+ are probable.

Risk\:Reward Analysis:

Risk = ₹350

Reward = ₹1,200–₹2,300

R\:R = \~1:3.4 to 1:6.5

#Trading #Investing #Stocks #TechnicalAnalysis

📌 Price: ₹4,902.90 📊 Volume: 138.03K 📅 Date: 19-05-2025

① Pattern Name, Timeframe, Structure & Explanation

Daily Timeframe: Rectangle Base Pattern (5 Months)

Weekly Timeframe: Base Formation in Uptrend

On the daily chart, BASF has been coiling inside a rectangle consolidation pattern between ₹4,300–₹4,800 for nearly 5 months. The base is tight, with volatility compression and a subtle rounding shape at the lower support, hinting at accumulation. The recent breakout from this rectangle comes on the back of strong bullish action with increasing range and volume — indicating supply absorption and demand dominance.

On the weekly chart, this move gains even more significance. BASF had spent nearly 3 years (2021–2023) inside a broad rectangle, eventually giving a massive upside breakout in 2024. The recent pullback post-highs around ₹8,750 has now rounded out into a basing structure — potentially forming the right side of a new base, suggesting a continuation of the broader uptrend.

② Volume Formation (During Pattern, Breakout, and Retest)

Daily Timeframe: Volume remained muted within the rectangle, showing lack of interest during the base — a common trait in high-quality accumulation phases. The breakout candle on 19 May shows volume spike to 138K, far above the base average, confirming institutional buying interest.

Weekly Timeframe: Volume clearly dried up during the correction phase post-2024 top, and has now started building up again as price reclaims previous support-turned-base zones.

③ Breakout Candlestick, Follow-Through & Trap Behavior

Breakout Candle (Daily): A wide-range, full-bodied bullish candle with gap-up characteristics and a +7.2% move, backed by a sharp volume surge — textbook breakout behavior

Follow-Through Watch: The stock may now retest the breakout zone of ₹4,750–₹4,800. A low-volume pullback would offer a healthy re-entry.

Trap Behavior: No signs of fakeouts or premature breakdowns. The rectangle was tight and clean — this breakout appears genuine and well-structured.

④ Trade Explanation (Entry, Target, Stop-loss, Risk\:Reward)

Entry Zone: ₹4,880–₹4,950 (near breakout close or minor dip)

Stop-loss: ₹4,600 (below rectangle low and base support)

*Target Zone: ₹6,200 (initial), ₹7,200–₹7,500 (long-term structure)

📏 Measured Move (Rectangle Range):

Range = ₹4,800 - ₹4,300 = ₹500

Target = ₹4,800 + ₹500 = ₹5,300 (short-term)

But considering weekly rounding base, extended moves toward ₹6,200+ are probable.

Risk\:Reward Analysis:

Risk = ₹350

Reward = ₹1,200–₹2,300

R\:R = \~1:3.4 to 1:6.5

#Trading #Investing #Stocks #TechnicalAnalysis

Learn Today for Better Tomorrow

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

Learn Today for Better Tomorrow

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน