OPEN-SOURCE SCRIPT

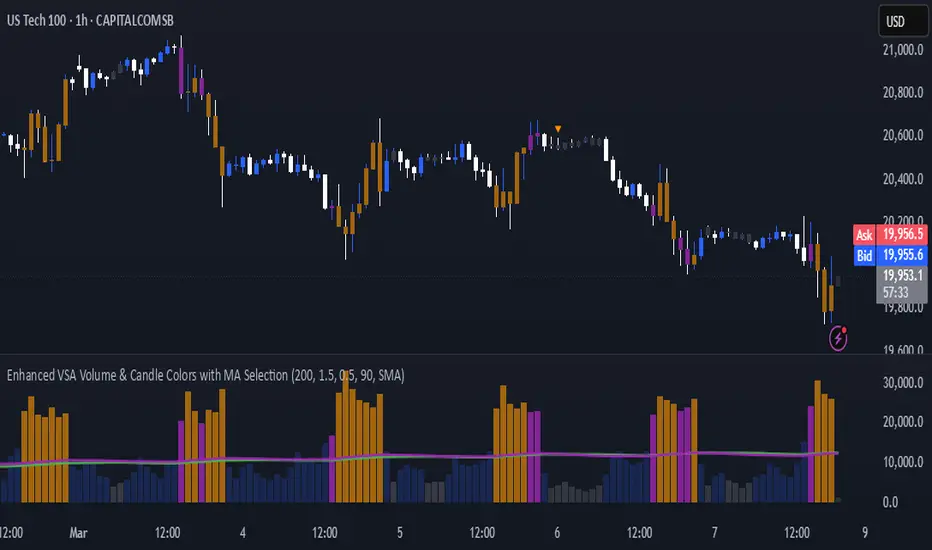

Enhanced VSA Volume & Candle Colors with MA Selection

Overview:

This script aims to enhance the visualization of volume spikes and price action by coloring volume bars and price candles dynamically based on the volume behavior. It allows traders to customize the type of volume moving average (SMA, EMA, or VWMA) used and apply various color schemes to highlight high, low, and extreme volume conditions. Additionally, alerts are generated when extreme or low-volume conditions occur.

---------------------------------------------------------------------------------------------------------------------

Key Features:

Customizable Volume Lookback Period:

Volume Multiplier Settings:

Percentile-Based Extreme Volume Detection:

Moving Average Selection:

Volume-Based Price Bar Coloring:

Dynamic Transparency and Color Customization:

Alerts:

---------------------------------------------------------------------------------------------------------------------

Script Components:

Volume Histogram Plot:

Smoothed Average Volume (EMA of Volume):

Price Bar Coloring:

---------------------------------------------------------------------------------------------------------------------

How It Can Be Used:

---------------------------------------------------------------------------------------------------------------------

Compliance with TradingView's House Rules:

No Promotion of Financial Products: The script does not promote any specific financial instruments or products, ensuring compliance with TradingView’s content guidelines.

Clear Functionality: The script provides clear, functional analysis tools without making unsupported claims about predicting market movements.

No Automated Trading: The script does not include any automated trading or order execution features, which complies with TradingView’s policy on non-automated scripts.

This breakdown ensures clarity on the script’s purpose, features, and how it might be used by traders. It's written in a way that fits TradingView's content guidelines, keeping the focus on providing valuable analytical tools rather than making promises or promoting any financial product.

This script aims to enhance the visualization of volume spikes and price action by coloring volume bars and price candles dynamically based on the volume behavior. It allows traders to customize the type of volume moving average (SMA, EMA, or VWMA) used and apply various color schemes to highlight high, low, and extreme volume conditions. Additionally, alerts are generated when extreme or low-volume conditions occur.

---------------------------------------------------------------------------------------------------------------------

Key Features:

Customizable Volume Lookback Period:

- The script allows users to define the period for calculating the moving average of volume (default: 200).

Volume Multiplier Settings:

- High and low volume thresholds are defined using multipliers. Users can adjust these to customize how volume is categorized (default multipliers: 1.5 for high volume, 0.5 for low volume).

Percentile-Based Extreme Volume Detection:

- The script calculates a percentile threshold for extreme volume (default: 90th percentile) based on the volume data, highlighting exceptionally high volume spikes.

Moving Average Selection:

- Users can choose between Simple Moving Average (SMA), Exponential Moving Average (EMA), or Volume Weighted Moving Average (VWMA) to track volume trends over the selected lookback period.

Volume-Based Price Bar Coloring:

- Price bars can be colored according to the volume conditions (high, low, or extreme). This feature can be toggled on or off.

Dynamic Transparency and Color Customization:

- The script allows users to set custom colors for different volume conditions (high, low, neutral, extreme) and adjusts the transparency of volume bars based on the relative size of the volume.

Alerts:

- Alerts can be set for when extreme volume spikes or low volume conditions are detected.

---------------------------------------------------------------------------------------------------------------------

Script Components:

Volume Histogram Plot:

- Displays the volume bars with dynamic coloring based on the volume condition (high, low, or extreme). The color of the bars adjusts for clarity, with transparency based on volume levels.

- Moving Average Plot:

- Plots the selected volume moving average (SMA, EMA, or VWMA) to visualize the trend of volume over the chosen lookback period.

Smoothed Average Volume (EMA of Volume):

- A smoothed EMA line is plotted to provide a clear representation of volume trends over time.

Price Bar Coloring:

- If enabled, price bars are colored according to the current volume condition, providing immediate visual feedback to the trader.

---------------------------------------------------------------------------------------------------------------------

How It Can Be Used:

- Volume Analysis for Entry/Exit Points: Traders can use the volume conditions (high, low, and extreme) to identify potential entry or exit points. High-volume bars often signal strong market activity, while low-volume bars may indicate consolidation or indecision.

- Volume Confirmation for Trend Reversal: Extreme volume spikes can sometimes precede significant price movements. Traders can monitor these spikes for potential trend reversal signals.

- Customizing Alerts: Alerts based on volume conditions help traders stay updated on important volume events without constantly monitoring the chart.

- Color-Coded Price Action: The dynamic coloring of price bars makes it easier to identify periods of strong or weak market participation, allowing traders to make informed decisions quickly.

---------------------------------------------------------------------------------------------------------------------

Compliance with TradingView's House Rules:

No Promotion of Financial Products: The script does not promote any specific financial instruments or products, ensuring compliance with TradingView’s content guidelines.

Clear Functionality: The script provides clear, functional analysis tools without making unsupported claims about predicting market movements.

No Automated Trading: The script does not include any automated trading or order execution features, which complies with TradingView’s policy on non-automated scripts.

This breakdown ensures clarity on the script’s purpose, features, and how it might be used by traders. It's written in a way that fits TradingView's content guidelines, keeping the focus on providing valuable analytical tools rather than making promises or promoting any financial product.

สคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้เป็นโอเพนซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันฟังก์ชันการทำงานของมันได้ ขอชื่นชมผู้เขียน! แม้ว่าคุณจะใช้งานได้ฟรี แต่โปรดจำไว้ว่าการเผยแพร่โค้ดซ้ำจะต้องเป็นไปตาม กฎระเบียบการใช้งาน ของเรา

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

สคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้เป็นโอเพนซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันฟังก์ชันการทำงานของมันได้ ขอชื่นชมผู้เขียน! แม้ว่าคุณจะใช้งานได้ฟรี แต่โปรดจำไว้ว่าการเผยแพร่โค้ดซ้ำจะต้องเป็นไปตาม กฎระเบียบการใช้งาน ของเรา

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน