PROTECTED SOURCE SCRIPT

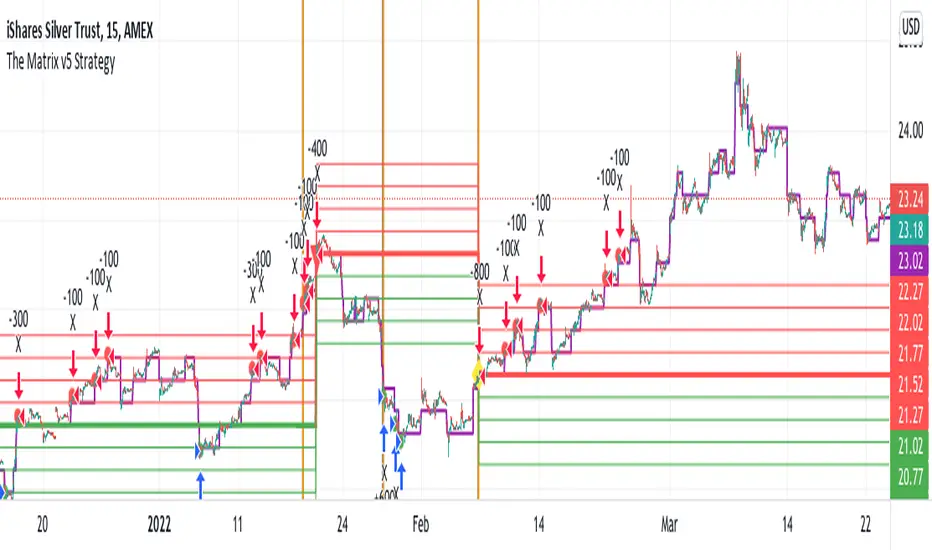

GRID Trading Optimized for Directional Markets

GRID trading is a popular trading strategy in Forex and Commodity markets.

It it however a tricky strategy when markets become directional.

This Directional GRID system adjusts its trading strategy and direction based on Overbought and Oversold RSI conditions on 2 timeframes.

It uses the short timeframe (chart) to trigger adjustments, so it delays buying/selling of all the levels, until it becomes overbought/sold

And it used the longer timeframe to trigger trading direction long/short.

This makes it far less likely to ever get "underwater", and builds in extra profit potential during market extremes.

I have coded it when i was trading SLV, but it could be optimized for any market using a "TradingView Strategy Input Optimizer".

Backtest based on a 25k max capital investment during 6 months.

Check the NET Profit (50%) result, and compare against the Buy & Hold (13.5%) return.

Losing trades are the ones that are currently open..

Av Bars in trades is the time between direction changes, as Position Adjustments are done more frequently.

Contact me for Trading Automation As A Service.

It it however a tricky strategy when markets become directional.

This Directional GRID system adjusts its trading strategy and direction based on Overbought and Oversold RSI conditions on 2 timeframes.

It uses the short timeframe (chart) to trigger adjustments, so it delays buying/selling of all the levels, until it becomes overbought/sold

And it used the longer timeframe to trigger trading direction long/short.

This makes it far less likely to ever get "underwater", and builds in extra profit potential during market extremes.

I have coded it when i was trading SLV, but it could be optimized for any market using a "TradingView Strategy Input Optimizer".

Backtest based on a 25k max capital investment during 6 months.

Check the NET Profit (50%) result, and compare against the Buy & Hold (13.5%) return.

Losing trades are the ones that are currently open..

Av Bars in trades is the time between direction changes, as Position Adjustments are done more frequently.

Contact me for Trading Automation As A Service.

สคริปต์ที่ได้รับการป้องกัน

สคริปต์นี้ถูกเผยแพร่เป็นแบบ closed-source อย่างไรก็ตาม คุณสามารถใช้ได้อย่างอิสระและไม่มีข้อจำกัดใดๆ – เรียนรู้เพิ่มเติมได้ที่นี่

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

สคริปต์ที่ได้รับการป้องกัน

สคริปต์นี้ถูกเผยแพร่เป็นแบบ closed-source อย่างไรก็ตาม คุณสามารถใช้ได้อย่างอิสระและไม่มีข้อจำกัดใดๆ – เรียนรู้เพิ่มเติมได้ที่นี่

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน