Charts Museum!!!👨🏫

Hello, my dear traders🙋🏻.

Welcome🌸 to the Charts section📈. My name is Pejman, and this is the Museum🖼️ of Technical Analysis in Tradingview. I'm your tour leader on this visitation, and we will get to know all the Charts well together📊. I'll provide the necessary information about each Chart and answer your questions✅.

🚫So during this tour, please don't eat🍟or touch the charts🙅🏻😄.

But it would help if you tried everything you learned at home.👍🏻😉

And if you have any questions, ask me in the comments👨💻.

In the previous post, I reviewed the life story of technical analysis💹. I said that the best friend of technical analysis was the Chart📉, which didn't separate from technical analysis all these years🤝🏻.

On the other hand, I said that fundamental analysis was closely related👥 to the Chart and fundamental information was also present in the charts.

So the Chart plays a significant👌🏻 role in the market.

(Definitely, the monitor🖥️ plays an essential role in using the computer🧑🏻💻 otherwise, we should all look at our motherboards💽😄.)

If you're a beginner and want to join us, read the previous post so that you can take the critical steps in learning technical analysis one by one.📃

Now, let's start this post with an example.😊

Each book can contain different information, but the amount of information obtained from each book is different and depends on you.📖

For example, maybe an adult learns valuable information about life from a children's storybook and likes that. Or perhaps a child, despite his age, will relate to a science book about astronomy and like it.👨🔬📕

So the amount of information we get depends entirely on us.💁

Regarding the charts, each Chart, like any book, gives us different information, but what you get from each Chart or which type of Chart you are comfortable with is entirely up to you.🙇♂️

So, like a good bookseller, I have to tell you all the information about my books so you can use the book that suits you.😉

But ultimately, the choice is yours. The customer is always right. 😂👌

So let's start this tour right away because learning the charts is one of the essential steps in this path.🏃♂️

-------------------------------------------------------------------------------------------------

The information about a price or stock can be displayed using different charts📊, and in the Tradingview platform, it is possible to use the best charts and even customize them🔧⚙️.

Charts are traders' working tools, like a painter👩🏻🎨 who paints with his tools🖌️🎨. Everyone likes to have the best tools🛠🥇.

In the TradingView platform, you can adjust your tools in any way you like👨🏻🔧.

On the other hand, if you get a Pro+ or Premium account, you can use most of the features for charts.✅️

In the following, we will get to know these features and facilities🙆🏻♂️.

Before starting the explanation, I used SWOT to easily understand the content in each chart, and I tried to share the information simply and based on the existing facts.💁♂️

SWOT stands for Strengths, Weaknesses, Opportunities, and Threats.

SWOT analysis facilitates a realistic, fact-based, and data-driven examination of information strengths and weaknesses.📈📉

We will check these characteristics in all the charts. So let's dive into the types of charts, learn about their advantages & disadvantages, and even compare them with each other.

👇

Let's go through the chart types in order of Tradingview's formation.

-----------------------------------------------------------------------------------------------------

Bars Chart:📊

The Bar Chart is very similar to Candle charts in terms of the information it provides.

This chart shows us information using horizontal and vertical lines.

Bar Charts give us four types of information about an asset.

This information is called OHLC, in which O means the Opening price, H is the Highest price, L signifies the Lowest price and C represents the Closing price of a bar in a time frame.💵

Each vertical line represents price changes over a time frame.

The horizontal lines on the left indicate the bar's opening price, and the horizontal line attached to the bar on the right side shows the closing price of that bar.➡️

Also, other information is obtained by continuing the vertical lines from above and below.

When a bar has an extra line at its bottom, that means the end of this line represents the bar's lowest price.

The upper line also represents the highest price in that time frame.

Finally, I want to say that bars charts and candles chart may seem a bit complicated, but they can reduce our trading mistakes with the information they provide.🙅♂️

For sure, choosing which type of chart you can trade better with is entirely up to you.

In the Tradingview platform, you can change the colors of the bars and customize your chart. 🔁

I have to say that this option is not available on some platforms, and if you can’t see the colors & the chart is only seen in black, using this chart will be a bit confusing.😟

-----------------------------------------------------------------------------------------------------

Candles Chart:🕯

You might have seen the Candles chart or heard their name.

This type of chart has become the most popular among traders.

What do you consider is the cause of the popularity of this type of chart?

Now that it's time for the most popular chart among traders let me talk more about the advantages and disadvantages of this chart.

However, certain things about this chart have made it the most popular chart.

Candles are like the scoreboard of a stadium, which shows the result of the match between buyers and sellers in a time frame.

Candles have a body & a wick like a real candle, and these wicks show the same highest and lowest price in a time frame.

The body of the candle also indicates price changes.

If the color of a candle is red, the price has decreased from the time of opening to closing.

And on the contrary, if the candle is green, the price closed higher than when it was opened.

In my opinion, this type of price display has a better visual effect. It can be an essential reference for making trading decisions, guessing the next candlestick, continuing a trend, or finding the reversal trend.

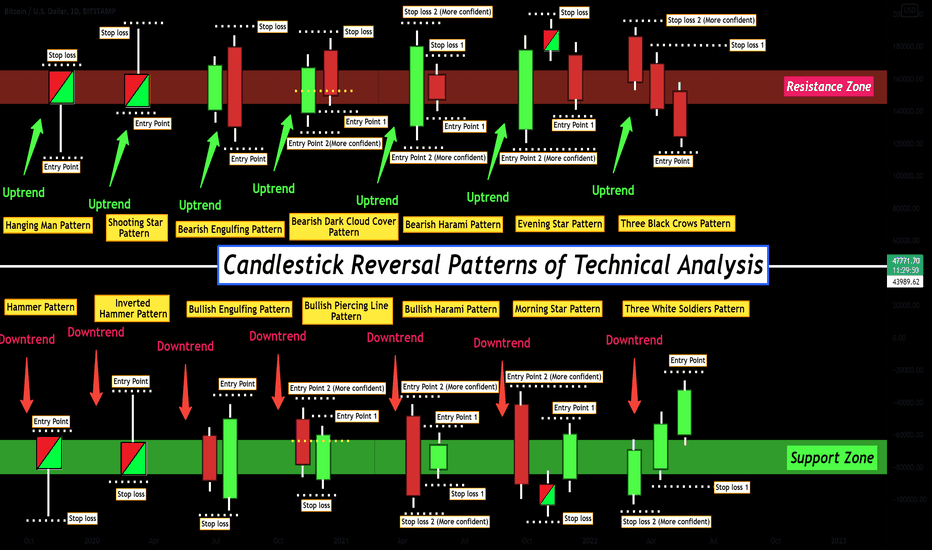

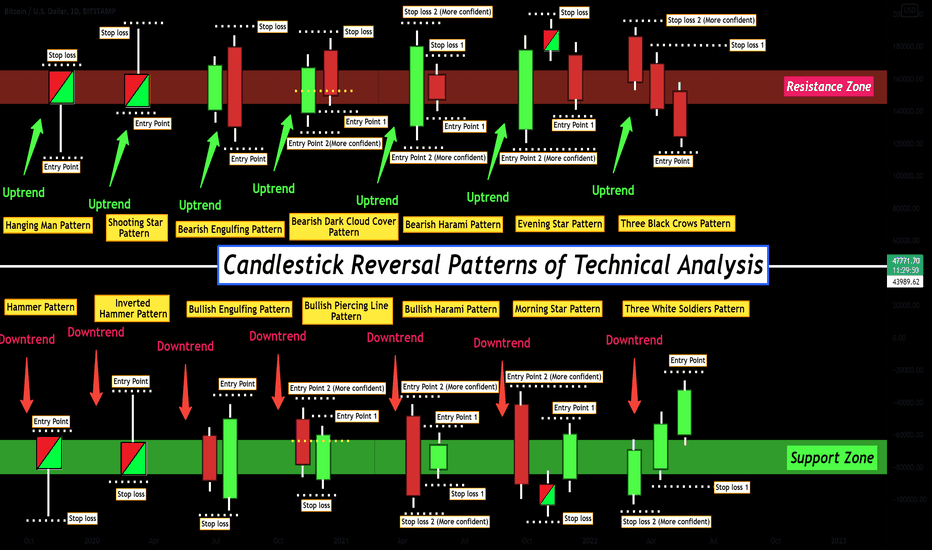

Candlesticks can form patterns alone or in pairs that help us predict the subsequent movements of the chart.

Candlestick patterns are either a continuation of a trend or reversal patterns, which generally have more number and variety and are even more helpful.

If you need to become more familiar with reversal candlestick patterns, check out the post below.

Also, most indicators work best with candle charts. If indicators are relevant to a particular trading system, often candlestick charts are required.

Candlestick charts display who controls a market or market sentiment over a given time frame. Through various candlestick patterns and formations, such as the Doji Patterns, etc. A trader can assess the overall bias over a specific time horizon.

Overall, Japanese candlesticks are clear, simple, and easy to describe. But definitely, there are some disadvantages.

One of these disadvantages is Apophenia(A tendency to relate unrelated things to each other).

It is a mental bias to see patterns in things that are accidental. Our brains want to see patterns, and so they do.

We are also looking for meaning, so we find meaning in meaningless things.

By combining technical analysis, we see patterns in random data and attach importance where there is none to said data. Candlestick charts are great for this trap.

When I was a beginner and couldn't control my emotions, I often saw trends the way I wanted to & this was far away from logic.

You can escape these emotional traps by practicing and studying to decide with logic and thinking.

Don't worry; as I said, you can count on my help because we will travel together on the technical analysis training road.

-----------------------------------------------------------------------------------------------------

Hollow Candles Chart:

This chart looks very similar to the Candles chart, but it may look a little more complicated, and as a beginner, you may need help understanding the meaning of these candles at first glance.

The system and function of candlesticks & hollow candles are entirely the same, and the difference between them is their appearance.

But still, I will write some points about this chart.

This chart shows OHLC the same as Candles and Bar charts, but on some platforms, it may be seen in colors other than the default colors (green and red - black and white).

But in general, this chart will show the price fluctuations entirely, and because of the similarity to the candle chart, it is less used.

-----------------------------------------------------------------------------------------------------

Column Chart:

As you can see, this chart consists of colored rows. For example, the green row indicates a price increase, and the red row shows a decrease.

It may give us incomplete information for trading, but if you want to compare statistics with each other or get information quickly and with a simple glance, these charts are suitable.

-----------------------------------------------------------------------------------------------------

Line Chart:

I want to examine the Line chart, which is the simplest type of Chart.➡️

A line chart consists of points connected by a line, and these points only represent the final price ( closing price ) of a currency or share.

This Chart can be suitable for comparing the information with each other at a superficial glance because it doesn't have any extra data. Apply two line charts on top of each other and see correlations between different assets.

Line charts are less used for trading; Because a line chart consists of points connected by a line, and these points indicate the closed price in a time frame and give us less information.

There are some other charts similar to line charts that are suitable for comparing information, which I will discuss below.

-----------------------------------------------------------------------------------------------------

Area Chart:

This Chart shows the changes in one or more sets of data and can be checked with other variables, but usually, the second variable is time, and the price is measured relative to time.

This Chart will be suitable for comparing two or more charts.

I put the advantages and disadvantages of this chart in the picture like other charts.

-----------------------------------------------------------------------------------------------------

Baseline Chart:

You may have noticed the similarities and differences between this chart and the Line and Area charts.

The Baseline chart looks similar to the above charts but with different levels; it provides us with more information than these two charts.

By default, there is a hypothetical line, as the average price line in the middle of this chart.

When the area is green, the price is above the average level, and if the area is red, the stock or currency is traded below the average price level.

You can adjust the baseline level. This level has a comparative aspect, and this type of chart is very suitable for checking the market's fluctuations.

-----------------------------------------------------------------------------------------------------

High-Low Chart:

This chart provides us with more information than the line and area chart. But this chart is not complete and does not show the opening or closing price & it only expresses the price changes from the lowest to the highest amount in a time frame.

-----------------------------------------------------------------------------------------------------

Heikin Ashi Chart:

The Heiken Ashi chart is well-known among traders, like the candles chart, and was first used in Japan.

By filtering price fluctuations and averaging between two consecutive candles, this Chart makes it easier to identify trends and helps traders avoid market excitement.

Take a look at the below chart to get to know this type of chart better.

I have to say that this chart type is helpful in the stock market and commodity market, which is associated with more gaps because they determine the price direction without gaps.

So if you feel it can be useful for you, test this chart along with your other strategies.

-----------------------------------------------------------------------------------------------------

Renko Chart:

This type of chart does not pay attention to time, so the time axis is not present in its structure.

This chart consists of sections called bricks or blocks, for which the amount of price change is determined, and the minor changes are not taken into account.

Each block shows a price move covering a user-defined number from the recent close. If the user selects ten numbers, each block will represent a ten-number movement in either direction.

New blocks will only form when the price moves by the set amount of numbers. However, these can be tricky because more price movement can happen than expected.

The Renko chart is one of the oldest and most famous Japanese charts. You can use this chart any time frame if you have a Pro + or Premium account on the Tradingview platform.

Otherwise, you can only have this chart in the daily time frame.

-----------------------------------------------------------------------------------------------------

Line Breaks Chart:

These charts are excellent indicators of momentum.

Each bar is called a "line," A new line will form if the new closing price is higher than the current close or the new close is lower than the last 3 bars.

You can change this number to any number of lines in the past.

But the most popular number among traders is "three lines in the past."

For this reason, this chart is also known as three broken lines.

-----------------------------------------------------------------------------------------------------

Kagi Chart:

Now it's the turn of a fancy line chart with a formula.

The Kagi chart works established on price and discounts the time axis.

Think of it as someone's finger showing you, "We reached -this- high & then -this low” 😂.

Kagi lines do not reverse unless the price changes the minimum amount.

However, what defines what gets plotted is if the price moves by more than a specified percentage from the most recent close.

The color of the lines will change based on new highs and lows.

If the new high is higher than the previous high, the color changes to green & if the new high is lower than the previous one, it would be red, signaling weakness in price.

-----------------------------------------------------------------------------------------------------

Point & Figure Chart:

Point and Figure charts were initially developed as a price recording system and later became technical analysis charts.

Before computers entered the world of Technical Analysis, this chart was widely used. Still, fewer people use it these days due to the complexity of understanding this chart and the limited information it provides.

These charts are like Renko blocks. The X's denote bullish moves, and the O's designate bearish moves by a set number.

All the rules involved in Renko blocks apply here; however, these charts look additional.

These simple charts focus only on significant price movements and completely filter out noises (minor price movements).

The unique aspect of these charts is that, unlike Candles, Line, and Bar charts, the time isn't directly considered in the chart.

Sometimes we can obtain good results and price targets from these charts, which are sometimes very special and significant.

So if you are curious to learn point & figure charts do more research (remember to practice a lot😊.

-----------------------------------------------------------------------------------------------------

Range Chart:

The last chart of this museum is another chart related to the price movement.

This chart may look like a bar chart, but I have to say that it's not.

It contains some of the information that the bar chart had.

If you add this chart, you will see that it has a different time frame than other charts.

100 ranges; As the name indicates, it includes 100 of the latest price movements you can see in different time frames. But, it has more than 100 ranges, and you can determine the number of these movements, which varies from 1 to 1000.

Welcome🌸 to the Charts section📈. My name is Pejman, and this is the Museum🖼️ of Technical Analysis in Tradingview. I'm your tour leader on this visitation, and we will get to know all the Charts well together📊. I'll provide the necessary information about each Chart and answer your questions✅.

🚫So during this tour, please don't eat🍟or touch the charts🙅🏻😄.

But it would help if you tried everything you learned at home.👍🏻😉

And if you have any questions, ask me in the comments👨💻.

In the previous post, I reviewed the life story of technical analysis💹. I said that the best friend of technical analysis was the Chart📉, which didn't separate from technical analysis all these years🤝🏻.

On the other hand, I said that fundamental analysis was closely related👥 to the Chart and fundamental information was also present in the charts.

So the Chart plays a significant👌🏻 role in the market.

(Definitely, the monitor🖥️ plays an essential role in using the computer🧑🏻💻 otherwise, we should all look at our motherboards💽😄.)

If you're a beginner and want to join us, read the previous post so that you can take the critical steps in learning technical analysis one by one.📃

Now, let's start this post with an example.😊

Each book can contain different information, but the amount of information obtained from each book is different and depends on you.📖

For example, maybe an adult learns valuable information about life from a children's storybook and likes that. Or perhaps a child, despite his age, will relate to a science book about astronomy and like it.👨🔬📕

So the amount of information we get depends entirely on us.💁

Regarding the charts, each Chart, like any book, gives us different information, but what you get from each Chart or which type of Chart you are comfortable with is entirely up to you.🙇♂️

So, like a good bookseller, I have to tell you all the information about my books so you can use the book that suits you.😉

But ultimately, the choice is yours. The customer is always right. 😂👌

So let's start this tour right away because learning the charts is one of the essential steps in this path.🏃♂️

-------------------------------------------------------------------------------------------------

The information about a price or stock can be displayed using different charts📊, and in the Tradingview platform, it is possible to use the best charts and even customize them🔧⚙️.

Charts are traders' working tools, like a painter👩🏻🎨 who paints with his tools🖌️🎨. Everyone likes to have the best tools🛠🥇.

In the TradingView platform, you can adjust your tools in any way you like👨🏻🔧.

On the other hand, if you get a Pro+ or Premium account, you can use most of the features for charts.✅️

In the following, we will get to know these features and facilities🙆🏻♂️.

Before starting the explanation, I used SWOT to easily understand the content in each chart, and I tried to share the information simply and based on the existing facts.💁♂️

SWOT stands for Strengths, Weaknesses, Opportunities, and Threats.

SWOT analysis facilitates a realistic, fact-based, and data-driven examination of information strengths and weaknesses.📈📉

We will check these characteristics in all the charts. So let's dive into the types of charts, learn about their advantages & disadvantages, and even compare them with each other.

👇

Let's go through the chart types in order of Tradingview's formation.

-----------------------------------------------------------------------------------------------------

Bars Chart:📊

The Bar Chart is very similar to Candle charts in terms of the information it provides.

This chart shows us information using horizontal and vertical lines.

Bar Charts give us four types of information about an asset.

This information is called OHLC, in which O means the Opening price, H is the Highest price, L signifies the Lowest price and C represents the Closing price of a bar in a time frame.💵

Each vertical line represents price changes over a time frame.

The horizontal lines on the left indicate the bar's opening price, and the horizontal line attached to the bar on the right side shows the closing price of that bar.➡️

Also, other information is obtained by continuing the vertical lines from above and below.

When a bar has an extra line at its bottom, that means the end of this line represents the bar's lowest price.

The upper line also represents the highest price in that time frame.

Finally, I want to say that bars charts and candles chart may seem a bit complicated, but they can reduce our trading mistakes with the information they provide.🙅♂️

For sure, choosing which type of chart you can trade better with is entirely up to you.

In the Tradingview platform, you can change the colors of the bars and customize your chart. 🔁

I have to say that this option is not available on some platforms, and if you can’t see the colors & the chart is only seen in black, using this chart will be a bit confusing.😟

-----------------------------------------------------------------------------------------------------

Candles Chart:🕯

You might have seen the Candles chart or heard their name.

This type of chart has become the most popular among traders.

What do you consider is the cause of the popularity of this type of chart?

Now that it's time for the most popular chart among traders let me talk more about the advantages and disadvantages of this chart.

However, certain things about this chart have made it the most popular chart.

Candles are like the scoreboard of a stadium, which shows the result of the match between buyers and sellers in a time frame.

Candles have a body & a wick like a real candle, and these wicks show the same highest and lowest price in a time frame.

The body of the candle also indicates price changes.

If the color of a candle is red, the price has decreased from the time of opening to closing.

And on the contrary, if the candle is green, the price closed higher than when it was opened.

In my opinion, this type of price display has a better visual effect. It can be an essential reference for making trading decisions, guessing the next candlestick, continuing a trend, or finding the reversal trend.

Candlesticks can form patterns alone or in pairs that help us predict the subsequent movements of the chart.

Candlestick patterns are either a continuation of a trend or reversal patterns, which generally have more number and variety and are even more helpful.

If you need to become more familiar with reversal candlestick patterns, check out the post below.

Also, most indicators work best with candle charts. If indicators are relevant to a particular trading system, often candlestick charts are required.

Candlestick charts display who controls a market or market sentiment over a given time frame. Through various candlestick patterns and formations, such as the Doji Patterns, etc. A trader can assess the overall bias over a specific time horizon.

Overall, Japanese candlesticks are clear, simple, and easy to describe. But definitely, there are some disadvantages.

One of these disadvantages is Apophenia(A tendency to relate unrelated things to each other).

It is a mental bias to see patterns in things that are accidental. Our brains want to see patterns, and so they do.

We are also looking for meaning, so we find meaning in meaningless things.

By combining technical analysis, we see patterns in random data and attach importance where there is none to said data. Candlestick charts are great for this trap.

When I was a beginner and couldn't control my emotions, I often saw trends the way I wanted to & this was far away from logic.

You can escape these emotional traps by practicing and studying to decide with logic and thinking.

Don't worry; as I said, you can count on my help because we will travel together on the technical analysis training road.

-----------------------------------------------------------------------------------------------------

Hollow Candles Chart:

This chart looks very similar to the Candles chart, but it may look a little more complicated, and as a beginner, you may need help understanding the meaning of these candles at first glance.

The system and function of candlesticks & hollow candles are entirely the same, and the difference between them is their appearance.

But still, I will write some points about this chart.

This chart shows OHLC the same as Candles and Bar charts, but on some platforms, it may be seen in colors other than the default colors (green and red - black and white).

But in general, this chart will show the price fluctuations entirely, and because of the similarity to the candle chart, it is less used.

-----------------------------------------------------------------------------------------------------

Column Chart:

As you can see, this chart consists of colored rows. For example, the green row indicates a price increase, and the red row shows a decrease.

It may give us incomplete information for trading, but if you want to compare statistics with each other or get information quickly and with a simple glance, these charts are suitable.

-----------------------------------------------------------------------------------------------------

Line Chart:

I want to examine the Line chart, which is the simplest type of Chart.➡️

A line chart consists of points connected by a line, and these points only represent the final price ( closing price ) of a currency or share.

This Chart can be suitable for comparing the information with each other at a superficial glance because it doesn't have any extra data. Apply two line charts on top of each other and see correlations between different assets.

Line charts are less used for trading; Because a line chart consists of points connected by a line, and these points indicate the closed price in a time frame and give us less information.

There are some other charts similar to line charts that are suitable for comparing information, which I will discuss below.

-----------------------------------------------------------------------------------------------------

Area Chart:

This Chart shows the changes in one or more sets of data and can be checked with other variables, but usually, the second variable is time, and the price is measured relative to time.

This Chart will be suitable for comparing two or more charts.

I put the advantages and disadvantages of this chart in the picture like other charts.

-----------------------------------------------------------------------------------------------------

Baseline Chart:

You may have noticed the similarities and differences between this chart and the Line and Area charts.

The Baseline chart looks similar to the above charts but with different levels; it provides us with more information than these two charts.

By default, there is a hypothetical line, as the average price line in the middle of this chart.

When the area is green, the price is above the average level, and if the area is red, the stock or currency is traded below the average price level.

You can adjust the baseline level. This level has a comparative aspect, and this type of chart is very suitable for checking the market's fluctuations.

-----------------------------------------------------------------------------------------------------

High-Low Chart:

This chart provides us with more information than the line and area chart. But this chart is not complete and does not show the opening or closing price & it only expresses the price changes from the lowest to the highest amount in a time frame.

-----------------------------------------------------------------------------------------------------

Heikin Ashi Chart:

The Heiken Ashi chart is well-known among traders, like the candles chart, and was first used in Japan.

By filtering price fluctuations and averaging between two consecutive candles, this Chart makes it easier to identify trends and helps traders avoid market excitement.

Take a look at the below chart to get to know this type of chart better.

I have to say that this chart type is helpful in the stock market and commodity market, which is associated with more gaps because they determine the price direction without gaps.

So if you feel it can be useful for you, test this chart along with your other strategies.

-----------------------------------------------------------------------------------------------------

Renko Chart:

This type of chart does not pay attention to time, so the time axis is not present in its structure.

This chart consists of sections called bricks or blocks, for which the amount of price change is determined, and the minor changes are not taken into account.

Each block shows a price move covering a user-defined number from the recent close. If the user selects ten numbers, each block will represent a ten-number movement in either direction.

New blocks will only form when the price moves by the set amount of numbers. However, these can be tricky because more price movement can happen than expected.

The Renko chart is one of the oldest and most famous Japanese charts. You can use this chart any time frame if you have a Pro + or Premium account on the Tradingview platform.

Otherwise, you can only have this chart in the daily time frame.

-----------------------------------------------------------------------------------------------------

Line Breaks Chart:

These charts are excellent indicators of momentum.

Each bar is called a "line," A new line will form if the new closing price is higher than the current close or the new close is lower than the last 3 bars.

You can change this number to any number of lines in the past.

But the most popular number among traders is "three lines in the past."

For this reason, this chart is also known as three broken lines.

-----------------------------------------------------------------------------------------------------

Kagi Chart:

Now it's the turn of a fancy line chart with a formula.

The Kagi chart works established on price and discounts the time axis.

Think of it as someone's finger showing you, "We reached -this- high & then -this low” 😂.

Kagi lines do not reverse unless the price changes the minimum amount.

However, what defines what gets plotted is if the price moves by more than a specified percentage from the most recent close.

The color of the lines will change based on new highs and lows.

If the new high is higher than the previous high, the color changes to green & if the new high is lower than the previous one, it would be red, signaling weakness in price.

-----------------------------------------------------------------------------------------------------

Point & Figure Chart:

Point and Figure charts were initially developed as a price recording system and later became technical analysis charts.

Before computers entered the world of Technical Analysis, this chart was widely used. Still, fewer people use it these days due to the complexity of understanding this chart and the limited information it provides.

These charts are like Renko blocks. The X's denote bullish moves, and the O's designate bearish moves by a set number.

All the rules involved in Renko blocks apply here; however, these charts look additional.

These simple charts focus only on significant price movements and completely filter out noises (minor price movements).

The unique aspect of these charts is that, unlike Candles, Line, and Bar charts, the time isn't directly considered in the chart.

Sometimes we can obtain good results and price targets from these charts, which are sometimes very special and significant.

So if you are curious to learn point & figure charts do more research (remember to practice a lot😊.

-----------------------------------------------------------------------------------------------------

Range Chart:

The last chart of this museum is another chart related to the price movement.

This chart may look like a bar chart, but I have to say that it's not.

It contains some of the information that the bar chart had.

If you add this chart, you will see that it has a different time frame than other charts.

100 ranges; As the name indicates, it includes 100 of the latest price movements you can see in different time frames. But, it has more than 100 ranges, and you can determine the number of these movements, which varies from 1 to 1000.

บันทึก

Well, my dear trader friends, I hope you were satisfied with visiting this part of the Tradingview Museum.🏛😀I have covered all the charts available in the Tradingview platform so that you can find the most suitable chart for you among the various types of charts.🧮

Of course, in the next steps, I will teach you how to trade with each chart, so you can make much better decisions and use the features of different charts.👍

We take the steps of this training together.🙏

So ask any questions you have, and be sure to find out about the authenticity of any article before using it.🧐

Study to find your trading system and practice a lot.🤓

Be healthy, happy, and successful.😉✌️

👑Real & Accurcy Free & VIP Signals👉 t.me/ProTrader_365

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

การนำเสนอที่เกี่ยวข้อง

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน

👑Real & Accurcy Free & VIP Signals👉 t.me/ProTrader_365

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

การนำเสนอที่เกี่ยวข้อง

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน