The core of this bullish thesis is that SNAP has moved past its period of post-IPO turbulence and is at an inflection point. The company, which has been undervalued due to market skepticism about its path to profitability and competition from rivals like TikTok and Meta, is now poised for a major rally. This is based on a confluence of factors, including a successful business pivot, strong user engagement trends, and a growing, diversified revenue stream.

Growing and Engaged User Base (DAUs/MAUs): Despite intense competition, SNAP continues to grow its user base, especially in the Rest of World markets. This growth indicates that the platform's unique focus on visual communication and friend-to-friend messaging is resonating with a global audience. The sustained increase in Daily Active Users (DAUs) and Monthly Active Users (MAUs) provides a solid foundation for long-term revenue growth.

Diversified Revenue Streams: While advertising remains the primary revenue driver, SNAP has successfully diversified its business. The rapid growth of Snapchat+, the paid subscription service, is a critical component of this thesis.

High-Margin Revenue: Snapchat+ provides a high-margin, recurring revenue stream that is less susceptible to macroeconomic advertising cycles. The growing subscriber count indicates strong user loyalty and a willingness to pay for premium features. This proves that SNAP is more than just an ad platform and has other avenues for monetization.

Advertising Platform Improvements: SNAP has made significant improvements to its advertising platform, particularly in direct-response (DR) advertising.

Improved ROI for Advertisers: By enhancing tools for small and medium-sized businesses and improving its ability to measure ad effectiveness, SNAP is attracting more advertisers and increasing their spending. This shift from brand-focused advertising to performance-based (DR) advertising is crucial for sustainable revenue growth.

AR as a Unique Differentiator: SNAP's focus on Augmented Reality (AR) is a major competitive advantage. The company's AR Lenses and shopping features are a unique and engaging way for brands to connect with consumers, positioning SNAP as a leader in a high-growth sector.

Operational Efficiency and Path to Profitability: After significant restructuring and cost-cutting measures, SNAP is showing a clear path to profitability.

Improved Margins: The company's focus on cost control, coupled with the growth of high-margin revenue streams like Snapchat+, is leading to improved profitability metrics like adjusted EBITDA. The company's balance sheet is also solid, with a strong liquidity position and improving cash flow.

Potential for Multiple Expansion: The market has been undervaluing SNAP, reflected in its low Price-to-Sales ratio. As the company demonstrates consistent user and revenue growth, and especially as it moves towards consistent profitability, a "re-rating" of the stock is likely. Investors will begin to see it as a mature growth company rather than a speculative tech stock, which could lead to a significant expansion of its valuation multiples.

Trade Idea:

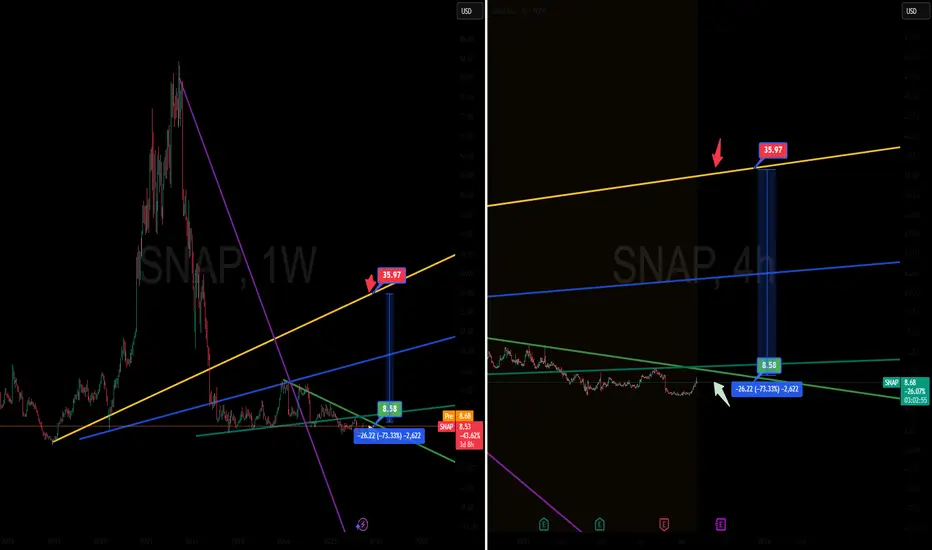

Entry at Green Arrow ($8.69): The green arrow marks a crucial technical support level. The price has likely hit a multi-year low or a major bottom, where sellers have exhausted their supply and strong buying interest has emerged.

Exit at Red Arrow ($35.97): The red arrow marks the price target for exiting the long position.

Disclaimer

This analysis is a hypothetical interpretation of a bullish trading strategy and is not financial advice. The rationale is constructed to justify the specified entry and exit points. All trading involves risk, and past performance is not indicative of future results.

Growing and Engaged User Base (DAUs/MAUs): Despite intense competition, SNAP continues to grow its user base, especially in the Rest of World markets. This growth indicates that the platform's unique focus on visual communication and friend-to-friend messaging is resonating with a global audience. The sustained increase in Daily Active Users (DAUs) and Monthly Active Users (MAUs) provides a solid foundation for long-term revenue growth.

Diversified Revenue Streams: While advertising remains the primary revenue driver, SNAP has successfully diversified its business. The rapid growth of Snapchat+, the paid subscription service, is a critical component of this thesis.

High-Margin Revenue: Snapchat+ provides a high-margin, recurring revenue stream that is less susceptible to macroeconomic advertising cycles. The growing subscriber count indicates strong user loyalty and a willingness to pay for premium features. This proves that SNAP is more than just an ad platform and has other avenues for monetization.

Advertising Platform Improvements: SNAP has made significant improvements to its advertising platform, particularly in direct-response (DR) advertising.

Improved ROI for Advertisers: By enhancing tools for small and medium-sized businesses and improving its ability to measure ad effectiveness, SNAP is attracting more advertisers and increasing their spending. This shift from brand-focused advertising to performance-based (DR) advertising is crucial for sustainable revenue growth.

AR as a Unique Differentiator: SNAP's focus on Augmented Reality (AR) is a major competitive advantage. The company's AR Lenses and shopping features are a unique and engaging way for brands to connect with consumers, positioning SNAP as a leader in a high-growth sector.

Operational Efficiency and Path to Profitability: After significant restructuring and cost-cutting measures, SNAP is showing a clear path to profitability.

Improved Margins: The company's focus on cost control, coupled with the growth of high-margin revenue streams like Snapchat+, is leading to improved profitability metrics like adjusted EBITDA. The company's balance sheet is also solid, with a strong liquidity position and improving cash flow.

Potential for Multiple Expansion: The market has been undervaluing SNAP, reflected in its low Price-to-Sales ratio. As the company demonstrates consistent user and revenue growth, and especially as it moves towards consistent profitability, a "re-rating" of the stock is likely. Investors will begin to see it as a mature growth company rather than a speculative tech stock, which could lead to a significant expansion of its valuation multiples.

Trade Idea:

Entry at Green Arrow ($8.69): The green arrow marks a crucial technical support level. The price has likely hit a multi-year low or a major bottom, where sellers have exhausted their supply and strong buying interest has emerged.

Exit at Red Arrow ($35.97): The red arrow marks the price target for exiting the long position.

Disclaimer

This analysis is a hypothetical interpretation of a bullish trading strategy and is not financial advice. The rationale is constructed to justify the specified entry and exit points. All trading involves risk, and past performance is not indicative of future results.

GoldenTraders is a premier trading community dedicated to helping you navigate the complexities of the financial markets with confidence and clarity.

Please join for more trade Ideas.

GoldenTraders: discord.gg/nrCvUT8yzt

Please join for more trade Ideas.

GoldenTraders: discord.gg/nrCvUT8yzt

คำจำกัดสิทธิ์ความรับผิดชอบ

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

GoldenTraders is a premier trading community dedicated to helping you navigate the complexities of the financial markets with confidence and clarity.

Please join for more trade Ideas.

GoldenTraders: discord.gg/nrCvUT8yzt

Please join for more trade Ideas.

GoldenTraders: discord.gg/nrCvUT8yzt

คำจำกัดสิทธิ์ความรับผิดชอบ

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.