Deepak fertilizer is ready to blast....

🔍 Thesis on Deepak Fertilisers (DEEPAKFERT): Technical + Fundamental Snapshot

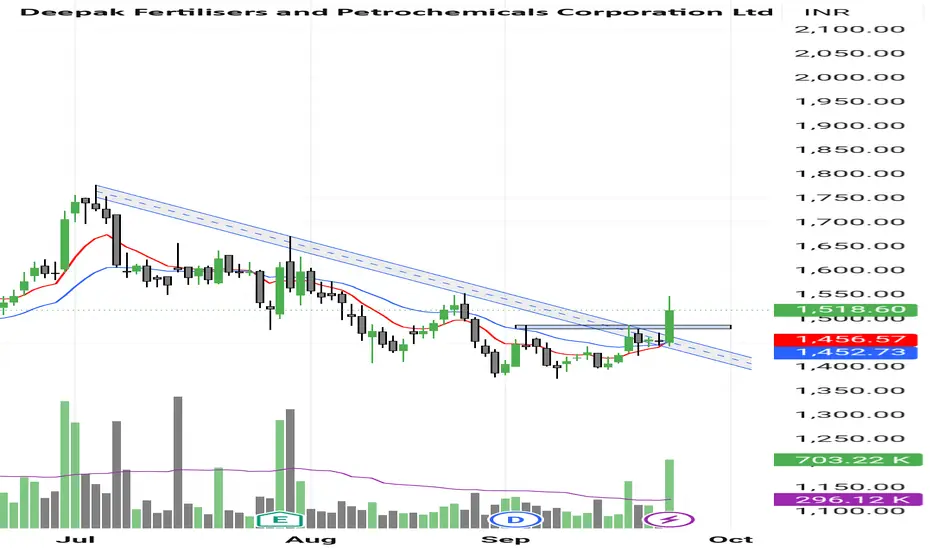

Technical outlook: The stock is showing bullish momentum—recent breakouts above key levels (e.g. around ₹1,450) have been met with confirmation. Indicators like moving averages and MACD lean positive, with many charts/screeners rating it a “Strong Buy” or “Buy.”

Support / Resistance context: Current price is below its 52-week high (₹888), indicating a favourable range captured with decent upside. The pullbacks have found support at prior breakout zones, which could now act as support.

Fundamentals: The company has been growing sales and profits robustly — revenue & net profit CAGR over recent years are in healthy double digits. Return on Equity (ROE) ~15-17%, debt to equity moderate (~0.6-0.7) giving some leverage but manageable.

Valuation & Risks: P/E ratio of ~18-20× is not cheap but not outrageously high relative to growth and sector peers. There are some risks: Operating margins have seen pressure; the chemicals segment has had weak demand at times. Also, while debt is manageable, interest coverage and cost pressures (input, energy etc.) remain variables.

Conclusion (balanced): Overall, Deepak Fertilisers appears to have a positive long-term fundamental base plus a bullish technical setup. Short-term, there is room for upside if the price can sustain above the breakout levels; downside risks exist if market sentiment turns or input costs rise sharply / demand softens.

Technical outlook: The stock is showing bullish momentum—recent breakouts above key levels (e.g. around ₹1,450) have been met with confirmation. Indicators like moving averages and MACD lean positive, with many charts/screeners rating it a “Strong Buy” or “Buy.”

Support / Resistance context: Current price is below its 52-week high (₹888), indicating a favourable range captured with decent upside. The pullbacks have found support at prior breakout zones, which could now act as support.

Fundamentals: The company has been growing sales and profits robustly — revenue & net profit CAGR over recent years are in healthy double digits. Return on Equity (ROE) ~15-17%, debt to equity moderate (~0.6-0.7) giving some leverage but manageable.

Valuation & Risks: P/E ratio of ~18-20× is not cheap but not outrageously high relative to growth and sector peers. There are some risks: Operating margins have seen pressure; the chemicals segment has had weak demand at times. Also, while debt is manageable, interest coverage and cost pressures (input, energy etc.) remain variables.

Conclusion (balanced): Overall, Deepak Fertilisers appears to have a positive long-term fundamental base plus a bullish technical setup. Short-term, there is room for upside if the price can sustain above the breakout levels; downside risks exist if market sentiment turns or input costs rise sharply / demand softens.

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน